- Analytics

- Market Overview

Most of currency pairs have been traded in the neutral trend on Tuesday - 8.1.2014

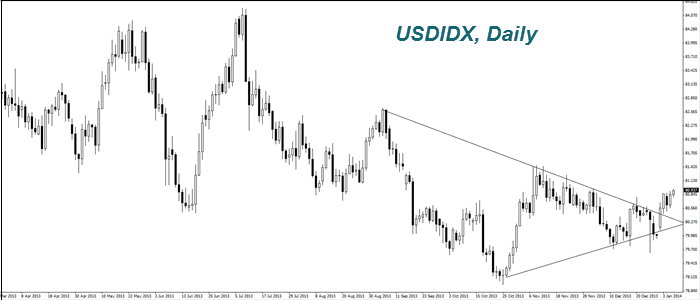

The dollar index (USDIDX) certainly rose, but the sharp reaction was more noticeable on the Japanese yen (USDJPY) and especially the Canadian dollar (USDCAD). The macroeconomic data came out in Canada yesterday. Unlike the U.S., they were clearly negative. The PMI in December unexpectedly plummeted to 46.3 points from 53.7 points in November. At the same time it was expected to grow to 54.5 points, according to forecasts. Besides investors were disappointed with increasing trade deficit in November. It was expected that Canada's trade performance would not bring any surprises. The deficit had to be at C $ 140 million instead of it, it rose to C $ 940 million ($ 879 million). Besides the size of the trade deficit for October was revised downwards. Of course, the currency market has reacted to all this information. The weakening of the Canadian dollar (USDCAD) reached its highest level in three and a half years. Daily decline against the U.S. currency was 1.2 %. It turned out to be the most significant since June of the last year. Note that it looks like the growth of the USDCAD on the chart in the trading terminal. Investors now put forward various hypotheses about imminent rate cuts in Canada. Theoretically, this could influence a further Canadian dollar weakening. According to western economists, ite will reach soon C $ 1,1-1,12. We particulary believe that the rate of the CAD will vary depending on outcoming macroeconomic information. Any levels are premature to predict. Tomorrow there is the Canadian real estate market data expected and the unemployment data is striking out on Friday. The Japanese Yen (USDJPY) continued its weakening against the U.S. dollar (an increase in the chart). We believe that this is due to repay of dollar-yen options at 105. Today expiration is about $ 650 million. The rate will vary in the future depending on the Japanese economic data. They will appear on Thursday and Friday.

The data on the US labor market from ADP is coming out today at 13-15 GMT ( 0) and the Fed meeting regarging monetary policy is to be held at 19-00 GMT (0). Market participants expect a moderate positive. In addition there will be the U.S. crude oil reserves weekly report released 15-30 GMT ( 0). According to preliminary estimates of the U.S. (EIA), crude oil reserves fell by 2.75 million barrels. Reserves of distillates, including heating oil, will increase by 2.25 million barrels and gasoline reserves - by 2.5 million barrels. We want to note that according to the forecast of the American Petroleum Institute (API) the growth of distillates reserves should be much bigger - 5.17 million barrels and gasoline - 5.58 million If the totals are less than expected, the oil price could rise. This contributes to the high demand for fuel due to cold weather in the United States. Thus, the temperature in New York fell to minus 16 degrees. This is a record frost since 1896. We note that the IFC markets has European oil Brent, and U.S. WTI available for trading.

See Also