- Analytics

- Market Overview

Fed minutes came out less optimistic than expected - 23.2.2017

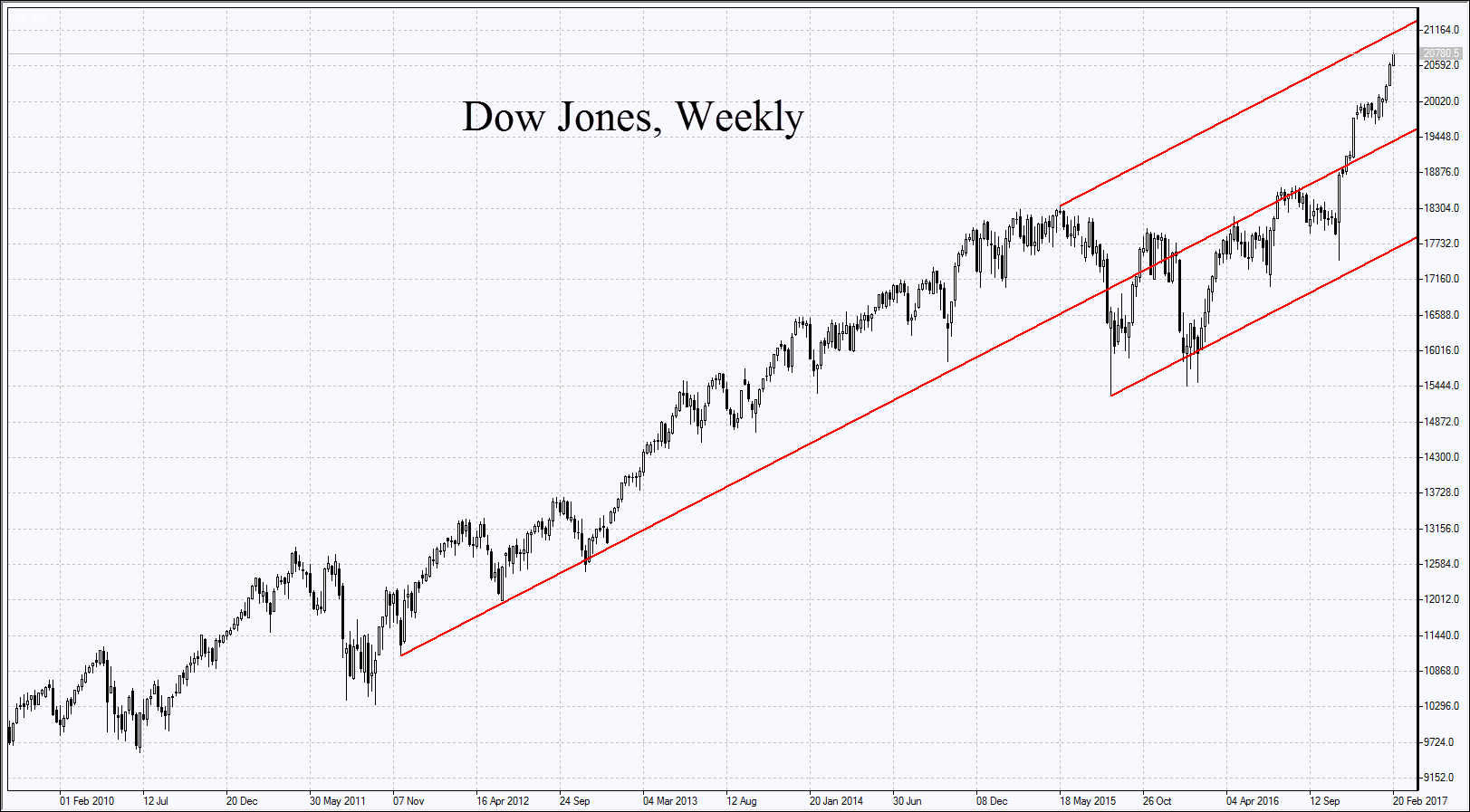

Dow Jones growth hits records

US stocks closed marginally lower on Friday together with US dollar. The Fed February meeting minutes at which the rates were left unchanged, slightly disappointed investors.

The majority of voting Fed Presidents expressed the opinion that risks of accelerating inflation are not high. There is enough time to hike the rates and no need to hurry. Last December Fed members left the room open for 3 interest rate hikes in 2017. The next Fed meeting will take place on March 15, 2017 and then on May 3, 2017. Given the Fed funds interest rate futures prices, the chances for the Fed rate hike in March are 27% and in May – 53%. The US stocks indices S&P 500 and Nasdaq Composite closed marginally lower. The Dow index hit a fresh historical high for the 9th straight time. Such a long rally is seen for the first time since 1987. The Dow index advanced yesterday after the EU competition authorities approved of the merger of DuPont and Dow Chemical companies. Their prices rose almost 4%. According to the recent forecasts, the total income of S&P 500 rose 7.6% in Q4 2016. This is the record advance since Q3 2014. Now the US stock market futures are the black. No significant economic data are expected to come out today in US.

Risks of French presidential elections are slightly lower

European stock indices edged higher yesterday having reached their 14-month high. The euro slightly advanced against the US dollar and other currencies amid lower political risks in France after the police detained some staff of the National Front leader Marine Le Pen.

She participates in the presidential elections and opts for France’ exit from EU. Some staff of National Front is suspected of organizing “fake jobs” in European Parliament. The European markets were supported by positive quarterly earnings from the British bank Lloyds, German Telefonica Deutschland, and positive news from ThyssenKrupp, Unilever, Ericsson, Fresenius Medical. Today in Germany the external trade data and GDP for Q4 will come out. They aligned with tentative outlook and did not affect the markets. The European stock indices and euro stood almost flat compared to the yesterday’s close

Japanese yen strengthened against the US dollar after the Fed minutes came out

Nikkei fell on Monday amid slight strengthening of Japanese yen as Fed minutes came out. Stocks of Rakuten soared 11% on the news about the buy back of 8.4% own stocks to the amount of 100bn yen ($882mln). Toshiba stocks surged 12% on the rumours the company may sell its memory chip making subdivision for 2trn yen. Nikkei index was almost flat on Friday. The stocks of Japanese financials edged lower after the US treasury yields fell in the aftermath of Fed meeting minutes and lower chances of the Fed rate hike. No significant economic data came out on Wednesday in Japan. On Thursday the leading economic indicator for December came out negative. Next time the significant economic data will come out in Japan on February 28, 2017.

Oil stockpiles showed the unexpected weekly fall in US, according to API

Oil prices slightly advanced due to the unexpected decline in its stockpiles, as American Petroleum Institute (API) reports. The stockpiles of crude oil fell 884 thousand barrels in a week to February 17 to 512,7mln barrels. Today at 17-00 СЕТ the official data on US stockpiles will be released by the US Energy Information Administration. It they also show the decline, this may push oil prices further up. Natural gas prices advanced on the news imports of LNG to China rose this January to 3.44mln tonnes. This is almost 40% above the reading of January 2016.

See Also