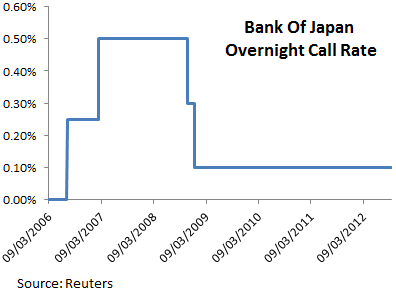

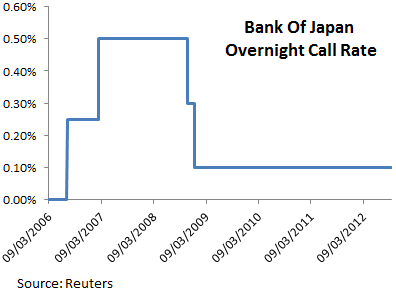

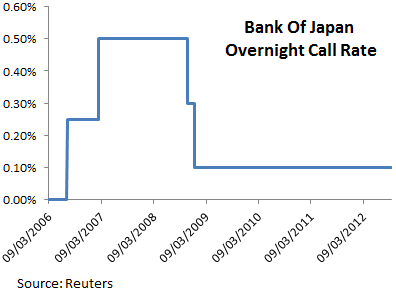

The Bank of Japan at its monetary policy meeting earlier today decided by unanimous vote to “enhance” monetary easing by increasing the size of Asset Purchases by 10 trillion Yen ($126.6 billion). The asset purchases will be divided 5 trillion Yen of T-bills and 5 trillion Yen of Japanese government bonds. Additionally the BOJ kept the overnight call rate at around 0.0 to 0.1% for money market operations. The Japanese CPI remains around 0% while growth is expected to ease due to weakening global economic activity and for that reason BOJ decided to increase stimulus.

The Japanese Yen weakened against its counterparties as the BOJ decision was not fully anticipated by market participants, the USDJPY rose from 78.57 to 79.20 or advanced 0.80%. The single currency against the Japanese Yen advanced by 122 pips or rose from 102.44 to 103.60.