- Analytics

- Market Overview

Weak macroeconomic data came out the U.S. on Friday - 10.2.2014

The Japanese Yen (USDJPY) weakened (it looks like the growth rate on the chart) after the negative macroeconomic indicators tonight. The positive current account balance for 2013 was 3.3 trillion yen. This is the lowest since 1985. In December, there was a record current account deficit. According to results of the last year the increase in imports was 15.4%, as for export - only 9%.

On Friday, the unemployment rate in Canada in January dropped to 7%. The number of employed rose by 29.4 thousand people, more than expected. This is further strengthened (reduction in the graph) Canadian Dollar (USDCAD). The labor market data reduced the possibility of cut in the interest rates in Canada. Today 13-15, we expect the real estate market data. The forecast is slightly negative.

The British Pound (GBPUSD) strengthened (growth on the chart) on Friday. Positive reaction of Forex market participants was caused by the trade deficit reduction in December to 7.72 billion Pounds, the lowest level since July 2012. This is better than expected. Tomorrow morning, there are data from the British Consortium of retailers on retail sales in January coming out. We can not exclude that they can support the Pound being based on preliminary forecasts.

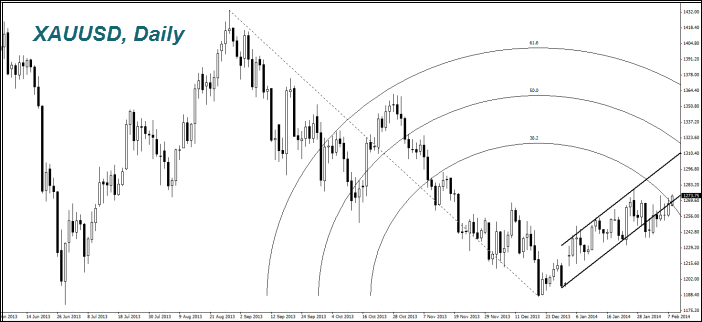

Gold (XAUUSD) increased in price due to a slowdown in employment growth in the United States. Typically, investors see it as a defensive asset in case of any deterioration signs for the economy of most developed countries. Last year, China became the world's largest consumer of gold. According to the China Gold Association, the consumption increased by 42% compared to 2012 and amounted to 1.176.4 tonnes. As it was previously predicted, the demand for gold in China may fall below 1.000 tonnes that this year. However, this has not happened yet. After the end of the celebration of the New Lunar Year buyers returned to the market. The premium between the price of Gold in Shanghai and London today increased to $ 12 per ounce from $ 11 on Friday

See Also