- Analytics

- Market Overview

US stocks finish at records on strong jobs data - 5.1.2018

Dow closes above 25000

US stock indices ended at record highs on Thursday with solid jobs data underpinning upbeat market sentiment. The dollar weakened: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, lost 0.4% to 91.848. Dow Jones industrial average rose 0.6% to record close 25075.13. The S&P 500 gained 0.4% to 2723.99 led by financial shares up 0.9%. The Nasdaq composite rose 0.2% to 7077.91.

Nine out of the 11 primary S&P 500 sectors finished higher on stronger than expected private sector hiring: employers added 250,000 jobs in December, more than the 190,000 jobs addition forecast, according to payroll processor ADP. The stock market rally, driven by tax cut stimulus expectations last year, continues as dollar weakness buoys US companies earnings prospects in overseas markets.

Carmaker shares lead European indices advance

European stocks extended gains on Thursday led by carmaker shares. The euro and British Pound advances against the dollar resumed. The Stoxx Europe 600 index rose 0.9% supported by positive services sector data for euro-zone. Germany’s DAX 30 rose 1.5% to 13167.89. France’s CAC 40 jumped 1.6% and UK’s FTSE 100 gained 0.3% to all-time closing high 7695.88. Indices opened mixed today.

Markit reported the final reading on the euro-zone’s services purchasing managers index came in better than expected at 56.6, up from November reading of 56.2. The services PMI climbed to 54.2 in December in the UK, from 53.8 the previous month. Auto maker shares rose on better than expected US car sales data.

Asian indices join global rally

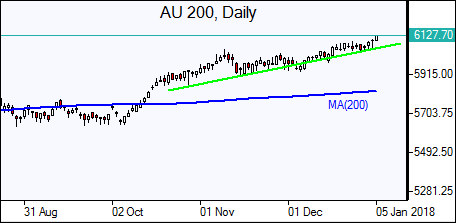

Asian stock indices are higher tracking Wall Street moves overnight. Nikkei rose 0.9% to 23720.00 on continued yen weakness against the dollar. Chinese stocks are rising: the Shanghai Composite Index is 0.2% higher and Hong Kong’s Hang Seng Index is up 0.1%. Australia’s All Ordinaries Index is 0.7% higher as Australian dollar fell against the greenback on a surprise November trade deficit.

Oil slips

Oil futures prices are edging lower today on expectations of higher US crude oil output forecast to cross above 10 million barrels per day. Prices rose yesterday on Iran unrest and US Energy Information Administration report of bigger than expected drop in domestic crude supplies of 7.4 million barrels last week. Brent for March settlement rose 0.3% to end the session at $68.07 a barrel on Thursday.

See Also