- Analytics

- Market Overview

US stocks slip on tax reform uncertainty - 8.11.2017

Dow logs a new record high

US stocks inched lower on Tuesday on uncertainty on timing and extent of proposed tax cuts under consideration in Congress. The dollar resumed strengthening: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.1% to 94.722. The S&P 500 slipped less than a point to 2590.61 led by financial and consumer discretionary stocks. Dow Jones industrial average rose less than 0.1% to record high 23557.23. The Nasdaq composite index fell 0.3% to 6767.78.

Earnings season continues with positive reports underpinning historically high stock valuations. House Ways and Means Committee Chairman Kevin Brady said the tax bill would be voted on next week. Senate has indicated its own bill will be unveiled Thursday. Economic news were positive: job openings rose to 6.04 million in September, close to a record high, and consumers borrowed $21 billion in September, the largest amount in almost a year, up from $13 billion in the previous month.

European stocks retreat on earnings misses

European stocks pulled back on Tuesday on weaker than expected corporate reports. The euro slid against the dollar while British Pound was little changed. The Stoxx Europe 600 fell 0.5%. German DAX 30 fell 0.7% closing at 13379.27. France’s CAC 40 closed 0.5% lower and UK’s FTSE 100 lost 0.7% to 7513.11. Markets opened 0.1%-0.2% higher today.

German DAX was weighed by 6.8% slump in Siemens Gamesa Renewable Energy shares after the wind turbines maker reported weaker than expected fiscal 2017 results and said it could reduce its workforce by more than a fifth. Markets shrugged off positive euro-zone data: euro-zone retail sales rose 3.7% over year in September, above the expected 2.8% gain.

Asian stock indices mixed

Asian stock indices are mixed today as data showed China’s demand for imports above expectations while export growth was slightly lower than expected. Chinese imports rose 17.2% in October from a year earlier, but export growth was at 6.9% just under an expected 7% gain. Chinese stocks are mixed: the Shanghai Composite Index is 0.04% higher and Hong Kong’s Hang Seng Index is down 0.2%. Nikkei ended 0.1% lower at 22913.82 on weaker yen against the dollar. Australia’s All Ordinaries Index gained 0.03% despite stronger Australian dollar against the greenback.

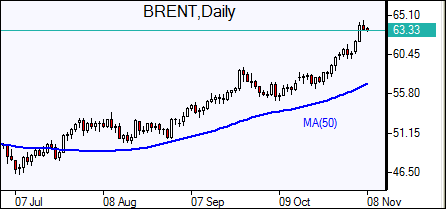

Oil lower on falling China imports

Oil futures prices are falling today as data showed China’s crude imports fell in October. China’s October oil imports fell to just 7.3 million barrels per day (bpd) in October from about 9 million bpd in September. Prices fell yesterday : January Brent fell 0.9% to $63.69 a barrel on Tuesday. The American Petroleum Institute industry group said late Tuesday US crude stocks declined by 1.56 million barrels last week. Today at 16:30 CET the Energy Information Administration will release US Crude Oil Inventories.

See Also