- Analytics

- Technical Analysis

Orange Juice Technical Analysis - Orange Juice Trading: 2018-01-08

Snowfalls in Florida may damage orange crops

Cold weather in the US state of Florida may reduce orange crops. Will the orange juice quotes advance?

An additional factor for their growth may be the USDA forecast on the orange crop reduction in the Brazilian states São Paulo and Triângulo Mineiro. The crop is expected to amount to 320 mln boxes (weighing 40.8 kg each) in the 2018/19 season. It is by 19% less than in the previous 2017/18 season. USDA predicts that the orange crop in Florida may reduce by a third compared to the previous season and amount to 44 mln boxes. It should be noted that the USDA made its report in December, and the possible crop reduction reflected the negative impact of hurricanes last year. Current heavy snowfalls and cooling in Florida, most likely, were not taken into account. Thus, the further deterioration of forecasts is not excluded.

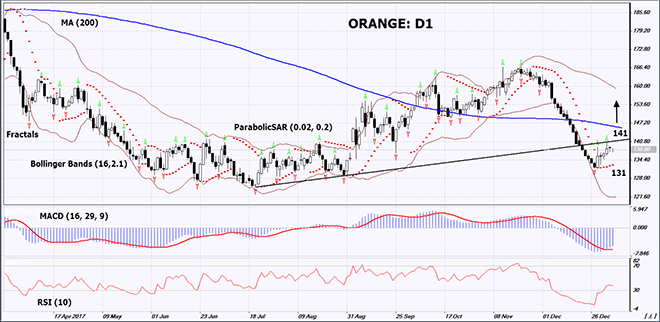

On the daily timeframe, ORANGE: D1 is correcting upwards after a significant decrease. Its further growth is possible in case of continual bad weather conditions in Florida and the USDA forecast decrease.

- The Parabolic indicator gives a bullish signal.

- The Bollinger bands have markedly widened, which means higher volatility.

- The RSI indicator is below 50. It came out from the oversold zone.

- The MACD indicator gives a bullish signal.

The bullish momentum may develop in case ORANGE exceeds the last fractal high and moves back to the previous rising trend at 141. This level may serve as an entry point. The initial stop loss may be placed below the Parabolic signal and the last fractal low at 131. After opening the pending order, we shall move the stop to the next fractal low following the Bollinger and Parabolic signals. Thus, we are changing the potential profit/loss to the breakeven point. More risk-averse traders may switch to the 4-hour chart after the trade and place there a stop loss moving it in the direction of the trade. If the price meets the stop level at 131 without reaching the order at 141, we recommend cancelling the position: the market sustains internal changes that were not taken into account.

Summary of technical analysis

| Position | Buy |

| Buy stop | above 141 |

| Stop loss | below 131 |

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.