- Analytics

- Technical Analysis

USD/CHF Technical Analysis - USD/CHF Trading: 2015-04-21

Preparing for probable triangle escape

Let us consider the USD/CHF currency pair on the daily chart. In our opinion, the Swiss franc is supposed to strengthen against the dollar. Amid rising concerns on Greece withdrawing from the EU, the Swiss currency is perceived by market participants as a haven asset. On Tuesday the EUR/CHF has got close to a 3-month low. To be mentioned, on April. 24 Latvia will hold EU finance ministers conference on the topic of additional monetary aid to Greece, so the country could avoid default. The default may force it to leave eurozone (so called Grexit). In theory, not so large sum of money – about 2 bln. euro – may prevent such a scenario. If the credit is granted, we do not exclude the euro and the Swiss franc to strengthen. The following eurogroup meeting will take place only on May, 11, when Greece will have to pay 750 mln. euro to IMF. On May, 8 Switzerland will publish April CPI, which may considerably affect the Swiss franc, but it is still a far-reaching prospect.

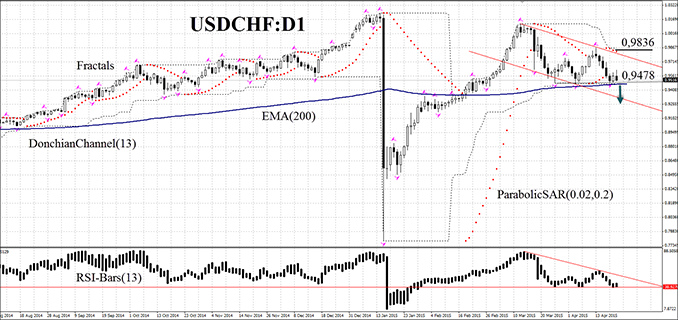

The USD/CHF currency pair has been consolidating on the daily timeframe and has formed a triangle pattern. The price has been decreasing at the moment, getting close to a 2-month low. Parabolic has shaped a sell signal. RSI bars chart has been located within the triangle as well. It has moved below 50 but hasn't yet reached the overbought zone. We do not rule out that the bearish momentum continues, if the USD/CHF breaches the triangle, breaks out the Donchian lower boundary, the Moving Average 200 and the fractal at 0.9478. A sell pending order may be placed at this level. A stop loss may be placed at Parabolic level 0.9836 or near the Donchian upper boundary and the latest fractal maximum. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the stop loss without reaching the order, we recommend cancelling the position: market sustains internal changes that were not considered.

| Position | Sell |

| Sell stop | below 0,9478 |

| Stop loss | above 0,9836 |

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.