- Analytics

- Technical Analysis

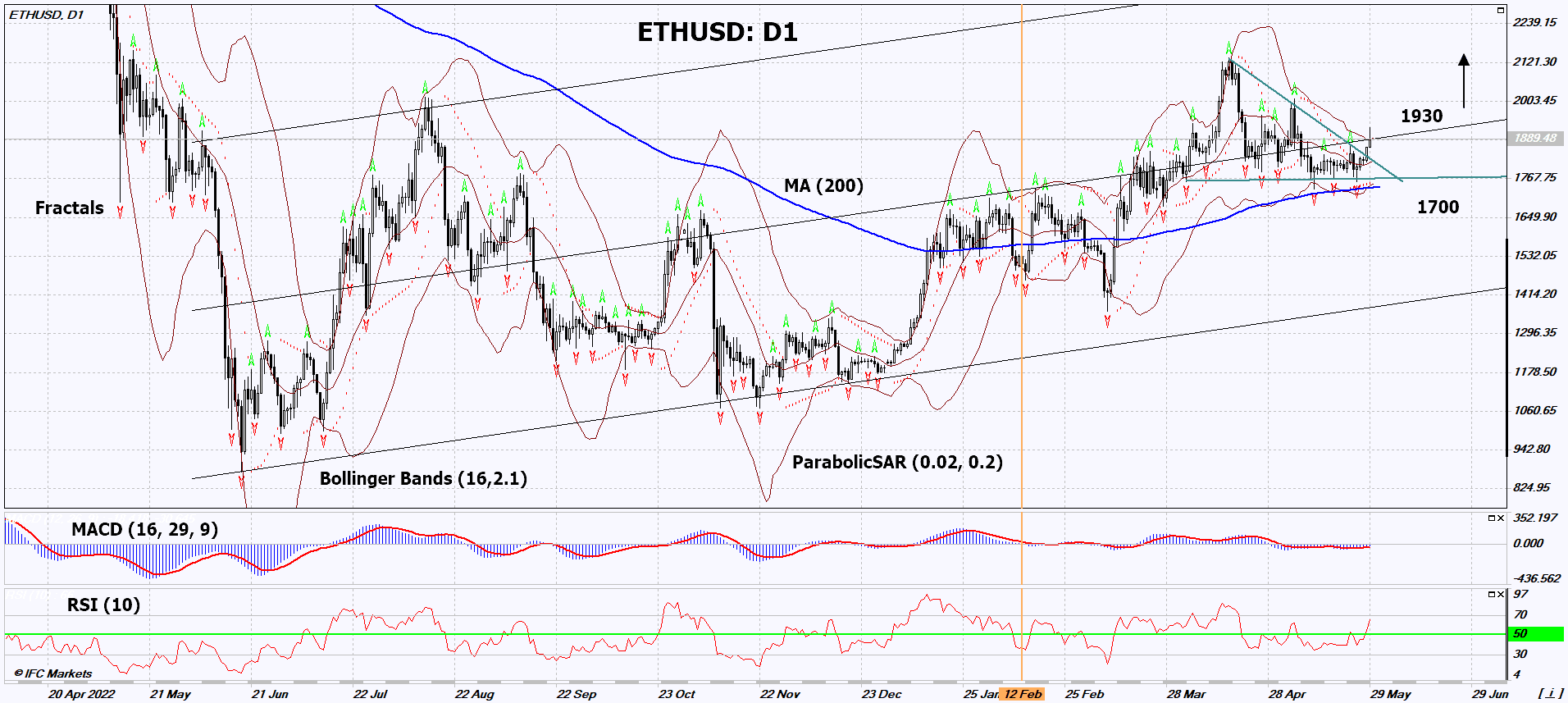

ETHUSD Technical Analysis - ETHUSD Trading: 2023-05-30

ETHUSD Technical Analysis Summary

Above 1930

Buy Stop

Below 1700

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Buy |

| MA(200) | Neutral |

| Fractals | Buy |

| Parabolic SAR | Buy |

| Parabolic SAR | Neutral |

ETHUSD Chart Analysis

ETHUSD Technical Analysis

On the daily timeframe, ETHUSD: D1 is within a long-term ascending channel and has broken out of a triangle pattern. Several technical analysis indicators have generated signals for further upward movement. We do not exclude a bullish trend if ETHUSD: D1 rises above the last high at 1930. This level can be used as an entry point. The initial risk limit can be set below the Parabolic signal, the last three fractal lows, the lower Bollinger Band, and the 200-day moving average line, around 1700. After opening a pending order, we move the stop loss along with the Bollinger Bands and Parabolic signals to the next fractal low. This way, we improve the potential profit/loss ratio in our favor. More cautious traders, after entering the trade, can switch to the four-hour chart and adjust the stop loss in the direction of the movement. If the price surpasses the stop level (1700) without activating the order (1930), it is recommended to cancel the order: there are internal changes happening in the market that were not taken into account.

Fundamental Analysis of Crypto - ETHUSD

Crypto market participants note the positive impact of the Shapella upgrade. Will ETHUSD quotes continue to rise?

The Shapella (Shanghai/Capella) Ethereum network upgrade took place on April 12, 2023. The majority of participants believe that it had a positive impact. Another factor contributing to the growth of Ethereum quotes could be the further reduction in the amount of Ethereum held in customer accounts on major cryptocurrency exchanges. This trend has been observed since September 2022 when reports of the bankruptcy of the FTX cryptocurrency exchange emerged. Additionally, there has been a simultaneous increase in the volume of Ethereum staking. Theoretically, this could indicate a decrease in the number of sellers of this cryptocurrency.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.