- تحليلات

- التحليل الفني للسوق

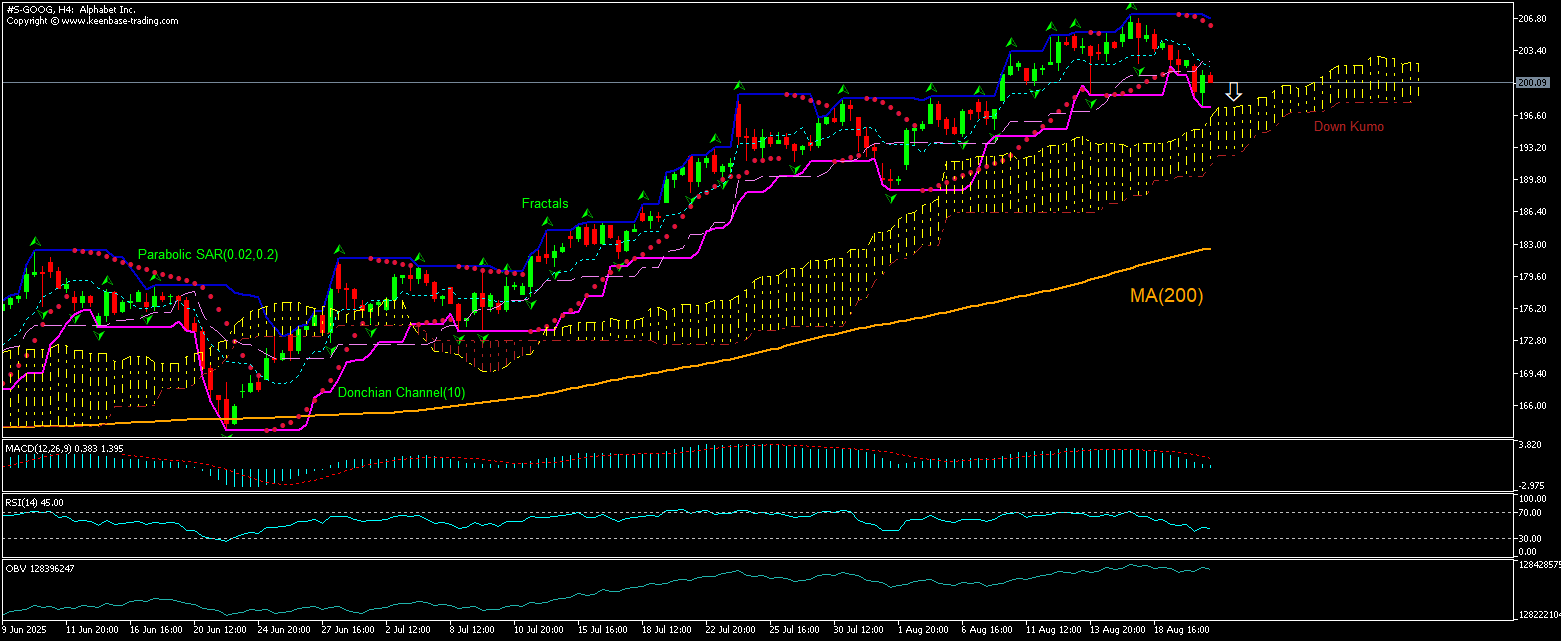

Alphabet التحليل الفني - Alphabet التداول: 2025-08-21

Alphabet ملخص التحليل الفني

أقل من 197.39

Sell Stop

أعلى من 206.08

Stop Loss

| مؤشر | الإشارة |

| RSI | محايد |

| MACD | بيع |

| Donchian Channel | بيع |

| MA(200) | شراء |

| Fractals | محايد |

| Parabolic SAR | بيع |

| On Balance Volume | بيع |

| Ichimoku Kinko Hyo | شراء |

Alphabet تحليل الرسم البياني

Alphabet التحليل الفني

يُظهر التحليل الفني لـسهم Google على الرسم البياني للإطار الزمني 4 ساعات أن #S-GOOG,H4 يتراجع هبوطًا باتجاه المتوسط المتحرك لـ 200 فترة (MA(200)) بعد أن ارتد قبل ستة أيام إلى أعلى مستوى خلال ستة أشهر. نعتقد أن الزخم الهبوطي سيستمر بعد أن يخترق السعر الحد السفلي لقناة دونشيان عند مستوى 197.39. ويمكن استخدام هذا المستوى كنقطة دخول لوضع أمر بيع معلَّق. أما إيقاف الخسارة فيمكن وضعه فوق مستوى 206.08. وبعد تفعيل الأمر، يُنقل أمر إيقاف الخسارة يوميًا إلى مستوى fractal high indicator وفقًا لإشارات مؤشر Parabolic. وبهذا نُغيّر نسبة الربح/الخسارة المتوقعة إلى نقطة التعادل. وفي حال وصل السعر إلى مستوى إيقاف الخسارة (206.08) من دون أن يصل إلى مستوى الأمر (197.39)، نوصي بإلغاء الأمر، لأن السوق قد شهد تغييرات داخلية لم تُؤخذ بعين الاعتبار.

التحليل الأساسي لـ الأسهم - Alphabet

استمر سهم Alphabet في التراجع بعد أن قامت الشركة بمراجعة شروط متجر Google Play. فهل سيتحوّل سعر سهم Google المتراجع إلى انعكاس صعودي؟

انخفض سهم Alphabet، الشركة الأم لـ Google، بنسبة 1.14% يوم الأربعاء بعد تقارير تفيد بأن الشركة تعمل على تحديث برنامج External Offers Program في الاتحاد الأوروبي مع رسوم معدلة وخيارات إضافية لمطوري نظام Android. أجرت Alphabet هذه التحديثات لتوفير مزيد من المرونة للمطورين كجزء من التزامها المستمر بقانون الأسواق الرقمية الأوروبي (DMA). في مارس، وجد جهاز الرقابة على المنافسة في الاتحاد الأوروبي أن Google لم تلتزم بالقانون في خدمتين. واتهمت المفوضية الأوروبية الشركة الأم Alphabet بأنها تعامل خدمات Google مثل Shopping وHotels وFlights "بشكل أكثر تفضيلًا" في نتائج البحث مقارنةً بالخدمات المقدمة من أطراف ثالثة، وأنها تمنح منتجاتها "معاملة أوضح وأبرز". كما أشارت المفوضية إلى أن متجر التطبيقات Google Play يمنع المطورين من توجيه العملاء إلى العروض وقنوات التوزيع التي يختارونها، ويفرض عليهم رسومًا غير عادلة مقابل اكتساب العملاء. تهدف شروط Google Play المعدلة إلى تسهيل مهمة المطورين في توجيه العملاء إلى منصات بديلة عن Google بعد أن خلصت المفوضية الأوروبية إلى أن الشركة انتهكت على الأرجح القوانين الأوروبية. ويتوجب على المطورين استيفاء شروط الأهلية وإكمال تسجيلهم في هذا البرنامج قبل الترويج للعروض الخارجية. أما مراجعة شروط نتائج البحث، التي ستُقيِّد المعاملة التفضيلية لخدمات Google مقارنةً بخدمات الأطراف الثالثة، فهي تمثل عاملًا سلبيًا (هبوطيًا) بالنسبة لسعر سهم Google.

استكشف

شروط التداول لدينا

- فروق الأسعار من 0.0 نقطة

- أكثر من 30,000 أداة تداول

- مستوى التوقف (الستوب أوت) - 10% فقط

هل أنت مستعد للتداول؟

فتح حساب :تنبيه

يحمل هذا الموجز طابعاً إعلامياً و تعليمياً و تنشر بالمجان . تأتي معظم البيانات المدرجة في الموجز من المصادر العامة معترفة أكثر و أقل موثوقية . مع ذلك ، لا يوجد تأكيد على أن المعلومات المشارة إليها كاملة و دقيقة . لا يتم تحديث الموجز . معظم المعلومات في كل موجز ، تتضمن الرأي و المؤشرات و الرسوم البيانية و أي شيئ اخر وتقدم فقط لأغراض التعريف وليس المشورة المالية أو توصية . لا يمكن اعتبار النص باكماله أو أي جزء منه و أيضاً الرسوم البيانية كعرض لقيام بصفقة بأي اداة . آي إف سي ماركيتس وموظفيها ليست مسؤولة تحت أي ظرف من الظروف عن أي إجراء يتم اتخاذه من قبل شخص آخر أثناء أو بعد قراءة نظرة عامة .