- Education

- Forex Trading Strategies

- Strategies by Forex Analysis

- Technical Analysis Strategy

- Range Trading Strategy

Forex Range Trading Strategy

KEY TAKEAWAYS

- Range trading is a forex trading strategy that involves the identification of overbought and oversold currency.

- Range trading strategy is sometimes criticized for being too simplistic, but in actuality it never failed.

- Traders, should look at long-term patterns that may be influencing the development of a rectangle.

- The complexity of irregular ranges requires traders to use additional analysis tools to identify these ranges and potential breakouts.

Forex Range Trading Strategy

Traders generally look for the best trading strategy to help them profit. Before attempting range trading, traders should fully understand its risks and limitations. Range trading strategy is becoming increasingly popular lately. But before we start, if you are new to Forex trading, it is best to start with the basics, “What is Forex trading and how does it work”.

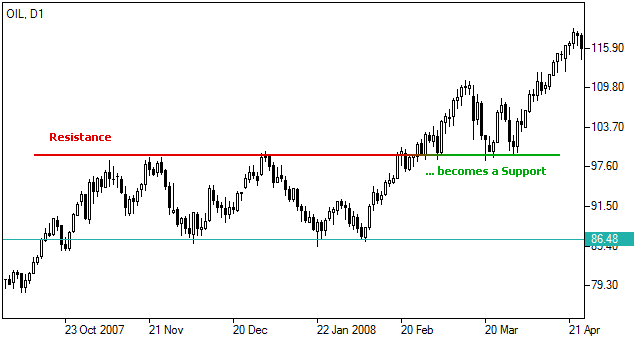

Range trading is a forex trading strategy that involves the identification of overbought and oversold currency, i.e buying during oversold/support periods and selling during overbought resistance periods. This type of strategy can be implemented nearly at any time, though it is preferable to use it when the market doesn’t have any distinguished direction, meaning is most effective when the Forex market has no discernible long-term trend in sight.

What is Range Trading

Range trading is an active investing strategy that identifies a range at which the investor buys and sells at over a short period. For example, a stock is trading at $55 and you believe it is going to rise to $65, then trade in a range between $55 and $65 over the next several weeks.

Traders might attempt to range trade it by purchasing the stock at $55, then selling if it rises to $65. Trader will repeat this process until he/she thinks the stock will no longer trade in this range.

Types of Range

To successfully trade while using Range trading strategy traders should know and understand the types of ranges. Here are the four most common types of range that you will find useful.

Rectangular Range - When using range trading strategy traders will see a rectangular range, there will be sideways and horizontal price movements between a lower support and upper resistance, it's common during most market conditions.

From the chart it is easy to see how the price movement of the currency pair stays within the support and resistance lines creating a rectangular (hence the name) range, from which traders clearly can see possible buy and sell opportunities.

Note: traders, should look at long-term patterns that may be influencing the development of a rectangle.

Diagonal Range is a common forex chart pattern. This type of range establishes upper and lower trendlines to help identify a possible breakout. In a diagonal range, the price descends or ascends via a sloping trend channel. This channel can be broadening, or narrowing.

Note: diagonal range breakouts take place relatively quickly, some can take months or years to develop, traders have to make decisions based on when they expect a breakout to occur, which can be hard.

Continuation Ranges is a graphical pattern that unfolds within a trend. These ranges occur as a correction against a predominant trend and can occur at any time as a bearish or bullish movement.

Note: continuation patterns take place within other trends, there is added complexity to evaluating these trades, especially for novice traders it is going to be hard to spot continuation ranges.

Irregular Ranges emerge differently from the previous three: trend take place around a central pivot line, and resistance and support lines crop up around it. That’s why it’s hard determining support and resistance lines. “Excellence" is not a gift, but a skill that takes practice, and applies to all Forex patterns.

Note: The complexity of irregular ranges requires traders to use additional analysis tools to identify these ranges and potential breakouts.

Bottom Line on Range Trading Strategy

Traders that choose to use Range trading strategy have to understand not only types of ranges, but the strategy lying behind using it.

Range trading strategy is sometimes criticized for being too simplistic, but in actuality it never failed. Traders need to identify the range, time their entry and control their risks of exposure and of course understand the fundamentals of hte strategy. Range trading can be quite profitable.

NEW TO TRADING OR WANT TO

IMPROVE YOUR LEVEL?

Check out our Trading Academy with

professional video lessons

and articles.