- Analytics

- Technical Analysis

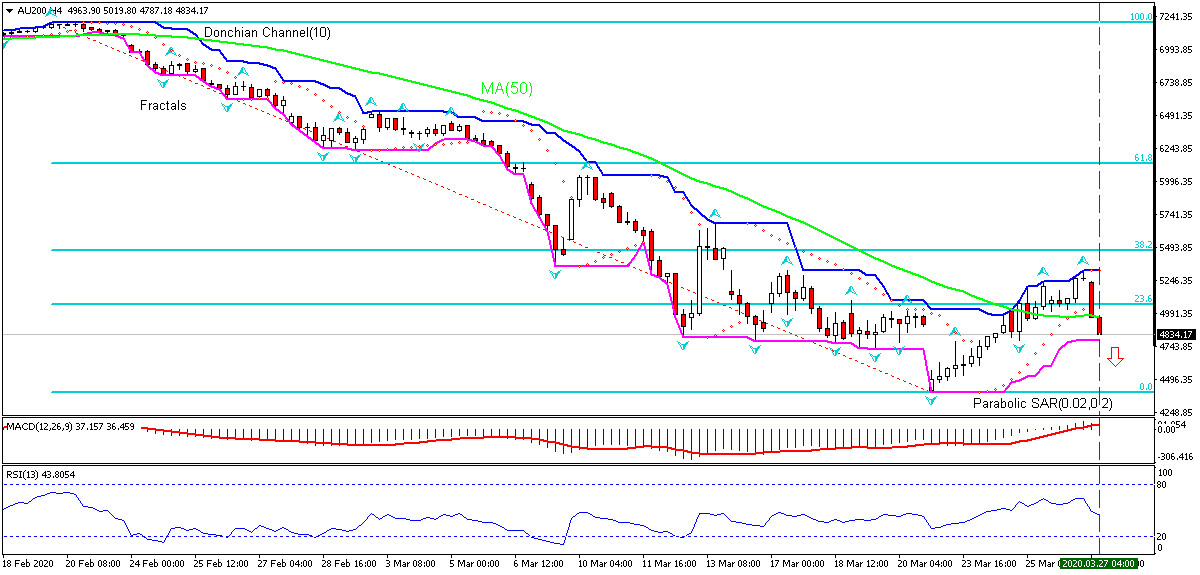

Australian Stock Index Technical Analysis - Australian Stock Index Trading: 2020-03-27

ASX 200 Index Technical Analysis Summary

Below 4787.18

Sell Stop

Above 5321.32

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Sell |

| Donchian Channel | Neutral |

| MA(50) | Sell |

| Fractals | Neutral |

| Parabolic SAR | Sell |

| Fibonacci | Sell |

ASX 200 Index Chart Analysis

ASX 200 Index Technical Analysis

On the 4-hour timeframe AU200: H4 has fallen back below 50-peiord moving average MA(200) which is falling. We believe the bearish momentum will continue after the price breaches below the lower Donchian boundary at 4787.18. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 5321.32. After placing the pending order the stop loss is to be moved every day to the next fractal high, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop-loss level (5321.32) without reaching the order (4787.18) we recommend cancelling the order: the market sustains internal changes which were not taken into account.

Fundamental Analysis of Indices - ASX 200 Index

Australia’s consumer confidence and PMI deteriorated more than forecast in recent weeks. Will the AU200 rebound reverse?

Australia’s economic data in the last couple of weeks were mixed: consumer confidence slipped in March and private sector contraction deepened. The Westpac Bank Consumer Confidence Index for Australia slipped to 91.9 in March from 95.5 in the previous month, when a decline to 94.7 was forecast. And the Commonwealth Bank Composite PMI for Australia fell to 40.7 in March from 49 in February, when a decline to 48.3 was expected. Readings below 50 indicate contraction while higher readings point to expansion. However the latest labor market report showed unemployment rate ticked down to 5.1% from 5.3% in February, partly due to slightly lower rate of labor force participation. Deteriorating data are bearish for AU200. Against the background of broadening impact of coronavirus on global economy, Australia’s central bank cut interest rates twice in two week period to a new record low of 0.25% aiming to cushion country’s economy against the impact of the coronavirus. At the same time Australia’s government launched an $11.4 billion stimulus package on March 12. The fiscal measures include payments to small businesses to encourage hiring, payment to people collecting government benefits such as old-age or veterans benefits, business subsidies in industries which have been hit hardest by the coronavirus (such as tourism). With many major governments embarking on fiscal and monetary stimulus programs to aid economies in weathering the downturn caused by coronavirus outbreak, investors confidence was boosted which was translated into a rebound in most stock markets. Recovering risk appetite is an upside risk for AU200.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.