- Analytics

- Technical Analysis

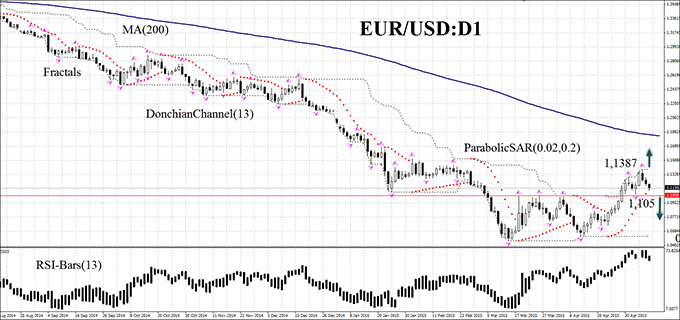

EUR/USD Technical Analysis - EUR/USD Trading: 2015-05-11

Statistics may affect euro

The strengthening of EURUSD on the daily chart slowed down because of the increasing risks on the debt repayment by Greece. On Tuesday Greece must pay 750 million euro to the International Monetary Fund. According to our analysts, the successful debt repayment might bolster further the euro and vice versa. Market participants estimate the Greece default possibility at 25%. Later, on Wednesday we expect the release of important macroeconomic information in the EU: Q1 GDP and Industrial Production in the euro zone in March, as well as the similar indicators for Germany and Italy. According to forecasts, the European GDP is expected to grow, and the German GDP is more likely to fall. US Retail Sales in April are also expected to be published on Wednesday. The tentative outlook is negative.

At the end of April EUR/USD:D1 finished the sideways trading and moved higher. Now there is a pullback and the price is close to the previous resistance line, which has currently become the support level for a new uptrend. RSI-Bars are located in overbought area and are also showing signs of retracement. The downward bias of the moving average (200) is decreasing. We deem that a bullish momentum might be formed after the price rising above the upper Donchian Channel boundary and the last fractal high at 1.1387, or crossing down the upper boundary of the previous range and the last fractal low at 1.105, in case of a bearish momentum. Let the market choose the price movement scenario. Two pending orders can be placed: when one of them is activated, the other can be canceled, since the market has chosen the direction. After pending order placing, Stop loss is to be moved every four hours to the next fractal high (short position) or fractal low (long position), following Parabolic signals. The most careful traders can switch to the H4 timeframe after order execution, placing Stop loss and moving it according to the price direction. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the Stop loss level without reaching the order, we recommend cancelling the position: the market sustains internal changes which were not considered.

| Position | Sell |

| Sell stop | below 1.105 |

| Stop loss | above 1.1387 |

| Position | Buy |

| Buy stop | above 1.1387 |

| Stop loss | below 1.105 |

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.