- PAMM accounts

- What is IFCM Invest

- What is PAMM Trading

What is PAMM Trading

PAMM (Percentage Allocation Management Module) is a form of trading on the Forex market, where the investor distributes his money between managers at his discretion. Managers, in turn, can manage multiple forex trading accounts using their own capital and pooled money to make a profit.

Since the investor has no control over the trade once it has been executed, it is important to choose the right manager. The investor can choose from a variety of candidates on the platform, where he will add his track record to his profiles, so it is better to choose one with a decent record in the past.

KEY TAKEAWAYS

- PAMM accounts are a means of bringing investors and traders together to earn from trading.

- The investor can choose from a variety of candidates on the platform, where he will add his track record to his profiles, so it is better to choose one with a decent record in the past.

PAMM trading is a good option for investors who do not have time to deal with financial markets.

What is PAMM Trading

PAMM accounts are a means of bringing investors and traders together to earn from trading.

With IFC Markets PAMM service, traders get access to a number of advantages on their accounts, such as spreads from 0.4 pips, instant execution, PAMM accounts on MT4 and MT5 platforms, as well as an access to more than 650 financial instruments that includes currency pairs, cryptocurrencies, commodities, ETFs, stocks, metals, indexes and others.

How does PAMM Trading Work

PAMM trading is a good solution for inexperienced investors who have no sufficient time or knowledge to commit to the process of trading on the Forex market.

To understand how PAMM trading works, it's best to look at an example.

Here goes

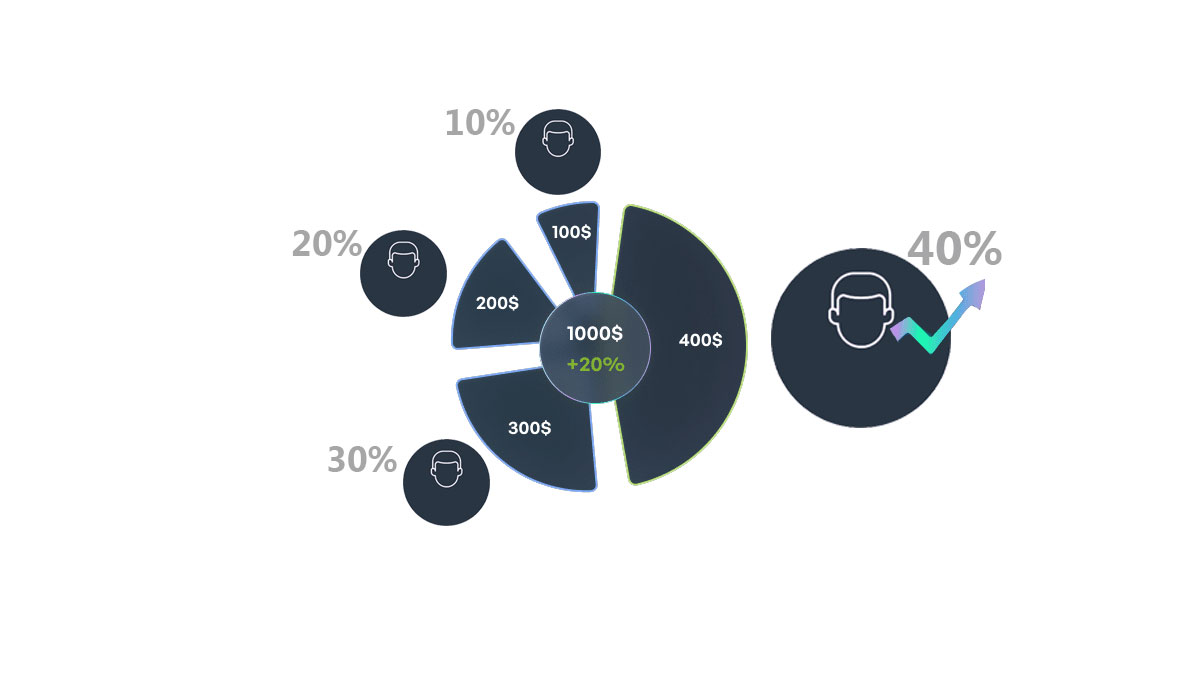

Let’s say a trader(manager) deposits $1,000 and investors contribute their own money to the manager's PAMM account as well. Investor X adds $2,000 and Investor Y adds $3,000. The total of the pooled funds is $6,000. The manager will trade through the PAMM account using the pooled funds of $6,000.

If the manager makes a 100% return - $6,000, they would take away their $1,000 investment plus $1,000 profit. Investor X would be able to withdraw their $2,000 investment plus $2,000 in profit and Investor Y would take their $3,000 plus $3,000 in profit.

Let's say the fund manager’s incentive remuneration was set at 10% of the total return, the trader would also benefit from Investors X and Y’s profit. The trader would earn $400 from Investor X and $600 from Investor Y, adding a total of $1000 to the trader’s overall profit.

PAMM Advantages

IFCM Invest offers PAMM trading which has a number of advantages for both investors and traders:

- This is very convenient for those who are new to trading - the manager makes decisions, and you will reap the rewards of their hard work. Investors can reproduce one or more successful trading strategies in their PAMM terminal.

- Access to more capital - PAMM managers have access to more capital than if they were simply trading their own funds. Pooled funds are more profitable than smaller investments.

- Save time - PAMM trading is a good option for investors who do not have time to deal with financial markets.

- Easy to Invest - Investors can deposit funds into their account once and then distribute those funds across multiple PAMM trading solutions.

- Less Risk - Because PAMM traders risk both their own capital and their investors' money. More experienced investors avoid managers who have only a small part of their own capital at stake.

- PAMM brokers act as guarantors - obligations between money managers and investors are guaranteed by the broker, and the master trader cannot disappear along with the investors' money. Although the trader manages the capital, he cannot withdraw it.

- Transparency - PAMM brokers usually provide a breakdown of a major trader's track record to help clients find a reliable trader.

- Rewards - profitable traders can profit from managing both their own capital and investors' funds.

Is PAMM Trading Safe

An important point when working with PAMM accounts is the choice of a broker. If the broker is well regulated, then your PAMM account is definitely safe.

As for the software behind the account, profits and losses are distributed automatically, so there is nothing to worry about here. Of course, any form of trading involves risk and there is no guarantee of profitability.

And the most important aspect in terms of risk is of course the fund manager you choose, as their skills and trading strategy ultimately decide whether you will make a profit or not.

Bottom line on PAMM Trading

PAMM trading technology allows investors with limited understanding of market trends to profit from Managers' expertise.

But despite the many advantages of PAMM trading, it can be difficult for beginners to develop their own skills. As a result, it's important to weigh your options, including the amount of time you have, your goals, and your tolerance for risk.