- Analytics

- Market Overview

San Francisco and New York Fed Presidents say rate hike is possible - 22.8.2016

US stocks slightly edged lower on Friday while the US dollar rose. No significant economic data came out. Market participants reacted on the statements from San Francisco and New York Fed Presidents that the rate hike is possible. The chances of the Fed rate hike rose to 53.5% from previous 48.8%, according to FedWatch. No significant economic data are expected to come out today in the US and Europe.

European stocks fell on Friday on negative corporate news from Vopak (-7%) and UniCredit (-6%) bank. The weekly fall of pan-European STOXX 600 index by 1.7% was the record high in 2 months. Today in the morning the European stocks are rising as the US regulator CFIUS approved of the acquisition by China National Chemical of the Swiss pesticides producer Syngenta (+12%) for $43bn. The euro fell on Monday for second straight day on the news the US interest rates may be hiked.

Nikkei slightly rose as Japanese yen weakened. The head of Bank of Japan Haruhiko Kuroda stated he did not rule out the further decline in interest rate to the negative. Currently the rate of Bank of Japan is -0.1%. Weaker yen improves the competitiveness of Japanese exporters. Tomorrow at 4-00 СЕSТ the manufacturing PMI for August will come out in Japan.

Oil fell on Monday as market participants doubt that OPEC members could finally manage to freeze the oil output on the meeting in Algeria on September 26-28, 2016 in course of the International energy forum. Additional factor that pushed the energy prices down was the 50% higher gasoline and diesel exports in July from China and the increase in active oil rigs in US by 10 units. The net longs in oil reached the 5-year high, according to U.S. Commodity Futures Trading Commission (CFTC).

Gold prices fell as US dollar strengthened after the US Fed members said the rate hike was possible. The SPDR Gold Shares fund reported an outflow of 4.5% tonnes of gold last week after the almost 20-tonne fall a week earlier. On Thursday August 25 the Fed President Janet Yellen will speak which may influence the gold and US dollar.

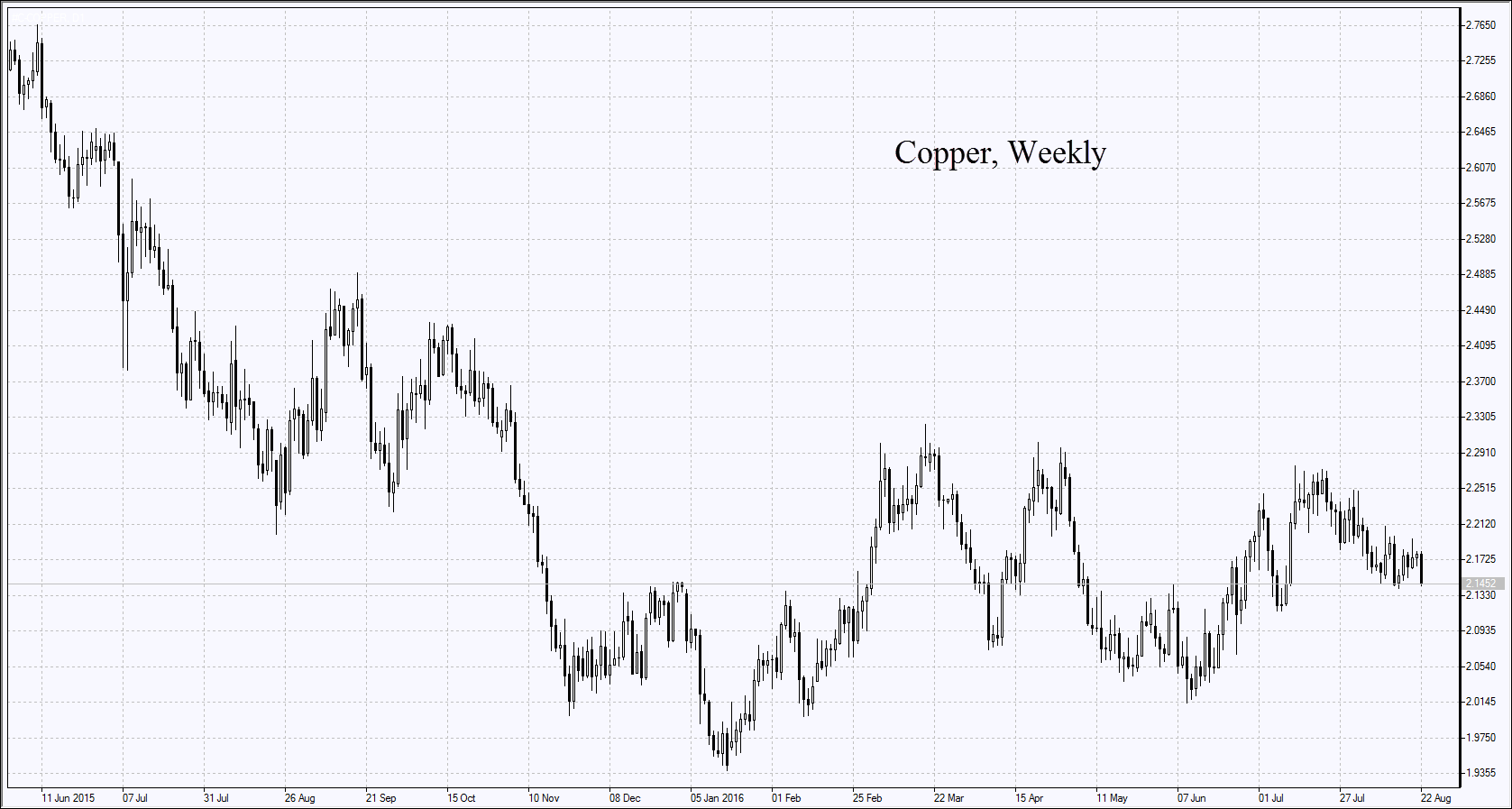

Copper fell on Monday after the report its exports from China rose this July to 75 thousand tonnes. This is almost 5 times more than in July 2015. The net long position in copper was formed last week while it was net short previously, according to CFTC.

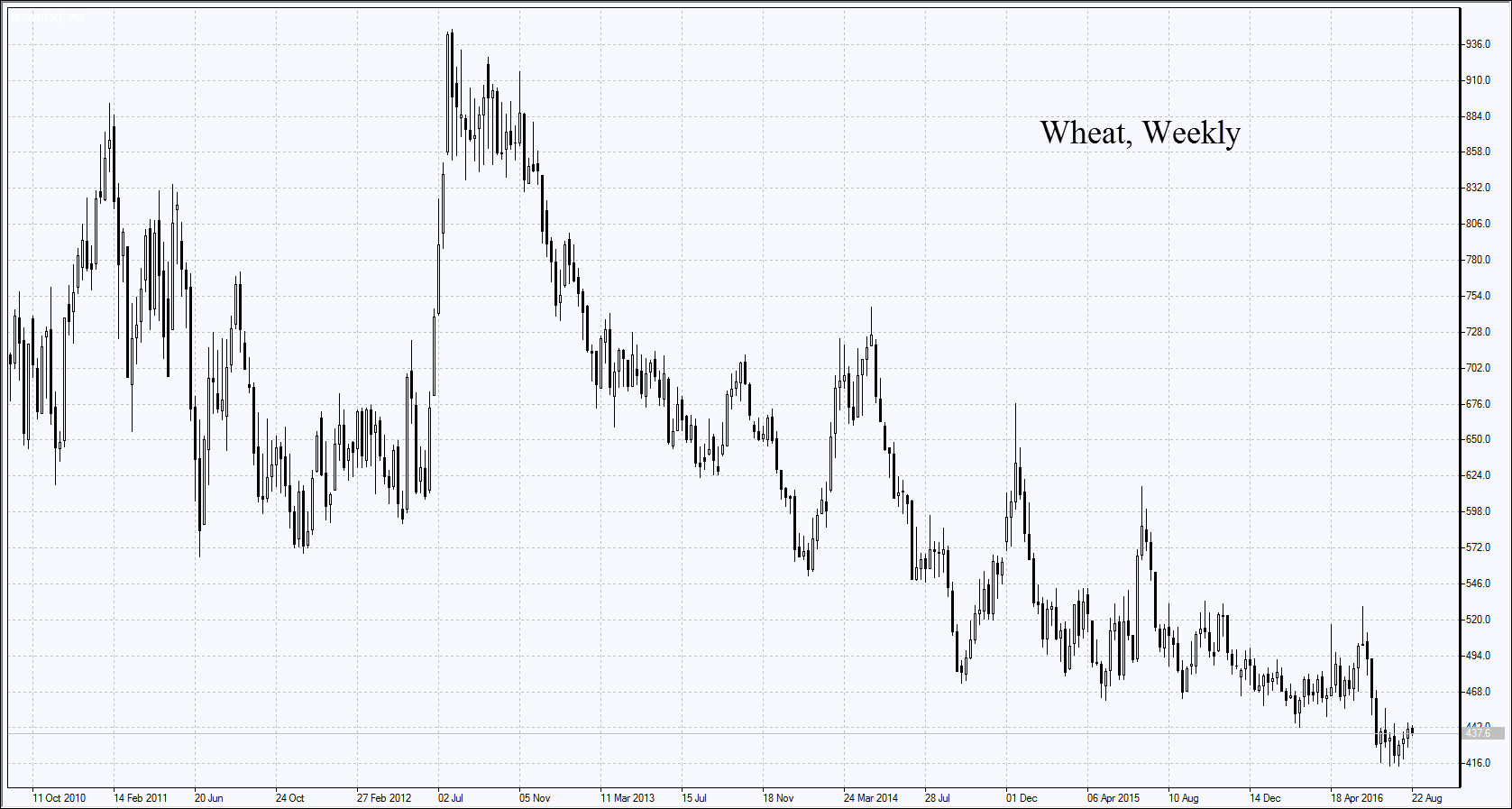

Corn and wheat prices slightly edged lower while soybeans advanced. The Russian Ministry of Agriculture raised forecast of wheat this year to 110mln tonnes which is above the historical high of 108mln tonnes hit in 2008. The Ministry suggested slashing the export duty on wheat to a zero till July 1, 2017. Sowings of soybeans in Argentina fell 4% as farmers decided to sow more corn. Its planting acreage rose by around 25% at the expense of other cultures.

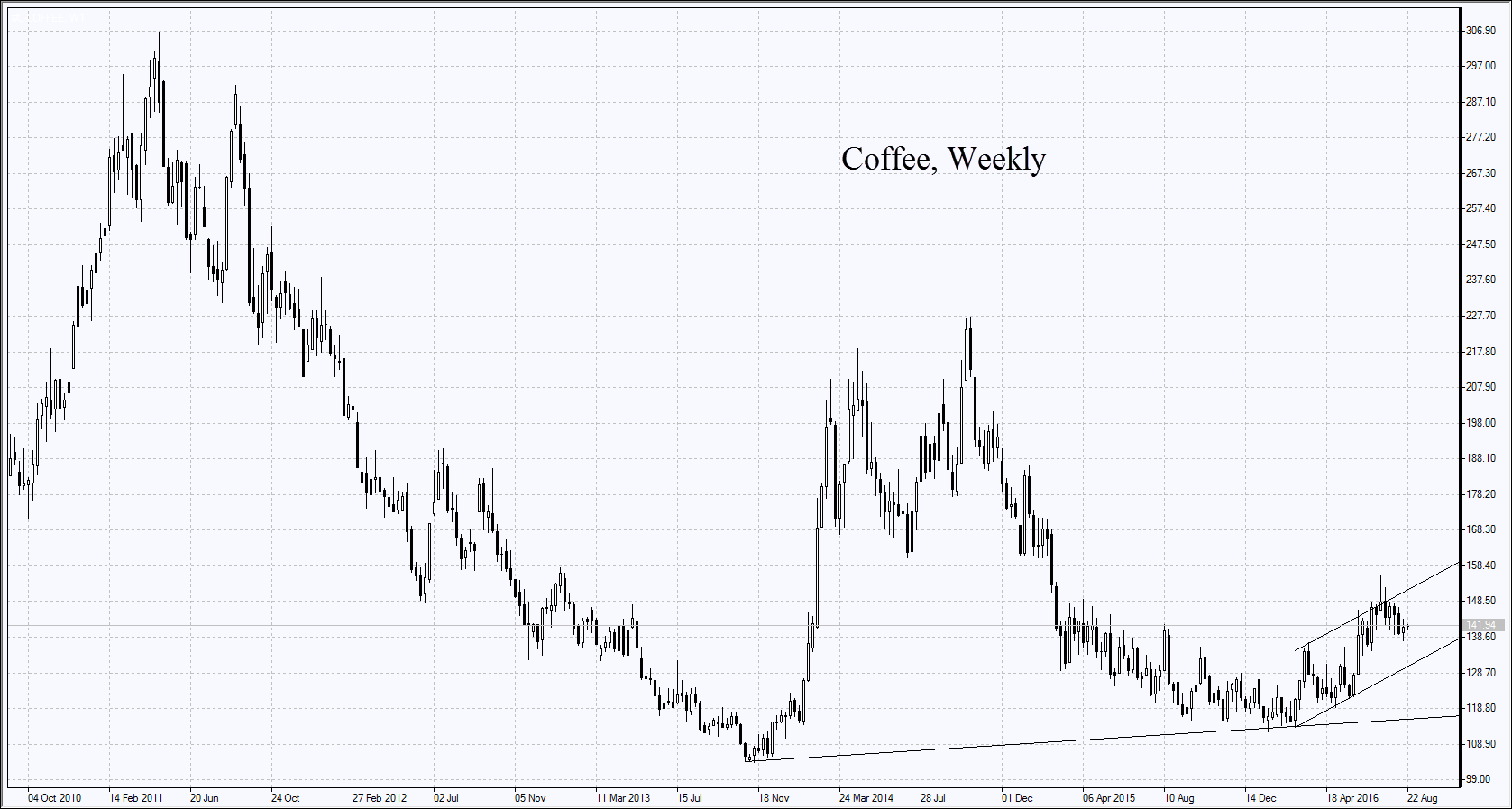

Coffee prices slightly edged up due to lower temperatures in Brazil and drought in Vietnam.

News

Oil Stocks and OPEC’s Credibility Problem

At the end of November, OPEC announced it would keep oil production flat through the first quarter of 2026. Historically,...

JPMorgan Data Fees And Why Europe’s PSD2 Got It Right

When Bloomberg and Reuters reported that JPMorgan Chase plans to charge fintech companies for access to customer bank-account...

DOGE Shutdown

Elon Musk and Donald Trump nicely leveraged public ignorance around the Department of Government Efficiency (DOGE) and Dogecoin...

Copper Price Analysis

Copper, often referred to as the metal of civilization, plays a pivotal role in various industries, including construction,...

Soybeans Price Analysis - Trends and Drivers

Soybeans have experienced significant price fluctuations over the past decades. From the 1970s through the early 2000s, soybean...

Warren Buffett Adds $521 Million to Chevron

Berkshire Hathaway made one of its biggest stock purchases last quarter, adding nearly $521 million worth of Chevron (CVX)...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also