- Analytics

- Market Overview

Stocks recover after US says all SVB depositors will be made whole - 13.3.2023

Todays’ Market Summary

- The Dollar weakening is intact

- US stocks indexes futures are up currently

- Gold prices are extending gains presently

Top daily news

Forex news

The Dollar weakening is intact currently. The live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, lost 0.4% Friday despite stronger than expected February jobs report while the unemployment rate rose when no change was expected.

Both EUR/USD and GBP/USD accelerated their climbing on Friday as the Office for National Statistics reported UK GDP grew 0.3% over month in January after 0.5% contraction in December when an 0.1% increase was forecast. Both Pound and euro are higher against the Dollar currently. Both USD/JPY and AUD/USD accelerated their retreating on Friday reversed with both the yen and the Australian dollar higher against the Greenback currently.

Stock Market news

US stocks indexes futures are up currently after closing solidly lower on Friday as the Federal Deposit Insurance Corporation announced it was seizing control of SVB and would reopen branches on Monday to allow customers to recover up to $250,000 in deposits. The three main US stock benchmarks recorded daily losses in the range from 1.1% to 1.8% on Friday with tech stocks leading losses.

European stock indexes futures are mixed currently after stocks closed lower on Friday with bank shares leading losses. Asian indexes futures are mostly higher today with Hong Kong’s Hang Seng index leading gains after newly reappointed Premier Li Qiang promised easier policies and reassured that the government will ensure its annual economic projections are met.

Commodity Market news

| Brent Crude Oil | --- | --- | --- |

| Cotton | --- | --- | --- |

Brent is extending gains currently. Prices ended higher on Friday as Baker Hughes company reported active US oil rigs count fell by 2 to 590 last week, their lowest since June. West Texas Intermediate (WTI) futures settled up 1.3% and is higher currently. Brent rose 1.5% to $82.78. Both benchmarks ended more than 3% lower on the week.

Gold Market News

| Gold USD | --- | --- | --- |

Gold prices are extending gains presently . Prices accelerated their gains on Friday: spot gold rose 2.06% to $1866.99 an ounce.

Crypto

| Bitcoin | --- | --- | --- |

| Ethereum - Dollar USA | --- | --- | --- |

News

How Big Corporations Legally Avoid the 21% Tax

The U.S. corporate tax rate is officially 21%. In theory, that is what profitable companies are supposed to pay. But in practice,...

Trader Makes $410,000 Betting on Maduro’s Removal

An unknown slick trader made $410,000 in profit by betting that Venezuelan President Nicolas Maduro would be ousted (kidnapped...

Stablecoin Supercycle - A Threat to Traditional Banking

The rise of stablecoins could change how global finance works. What started as a market worth about $200 billion is expected...

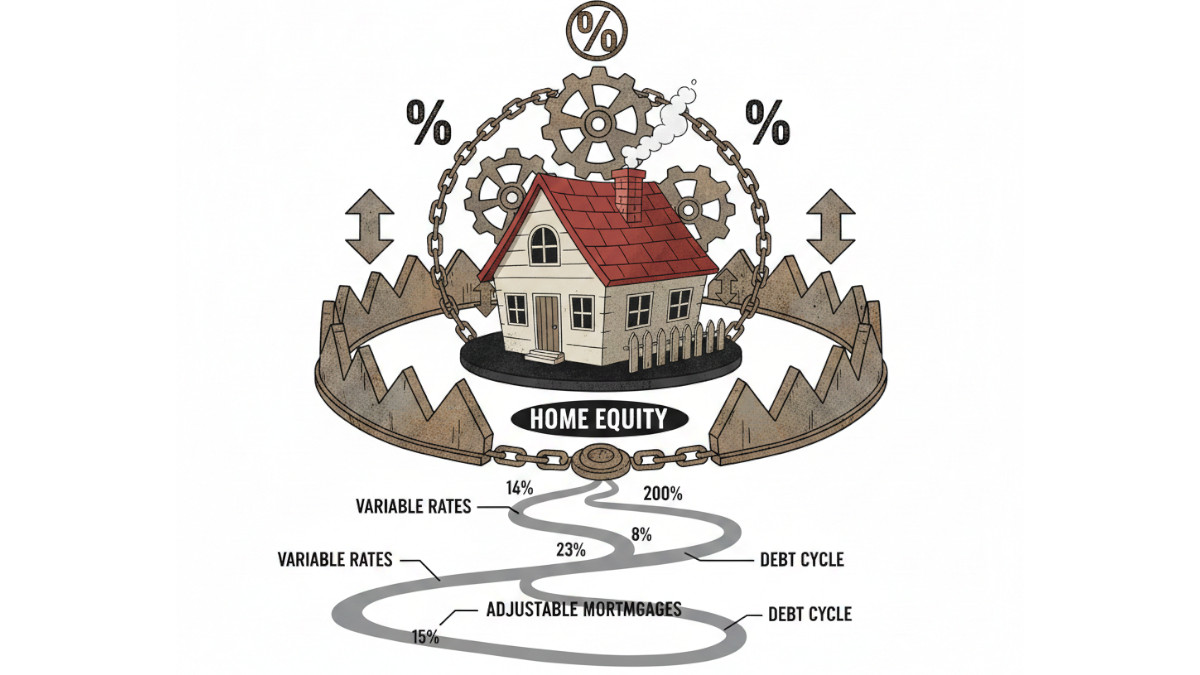

The 2026 Rate Trap

The Federal Reserve just cut interest rates for the third time, bringing them to a range of 3.50% - 3.75%. However, investors...

AI That Steals Faster Than You Can Audit

The era of manual auditing in DeFi is ending. GPT-5 and Claude's can autonomously identify and exploit vulnerabilities in...

Oil Stocks and OPEC’s Credibility Problem

At the end of November, OPEC announced it would keep oil production flat through the first quarter of 2026. Historically,...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also