- Analytics

- Market Overview

Stocks rebound after Wall Street dip - 19.9.2024

Todays’ Market Summary

- The Dollar weakening is intact

- The US stock index futures are up currently

- Gold prices are rebounding

Top daily news

Global equity indexes are rising currently after Wall Street dipped on Wednesday following Federal Reserve decision to cut interest rates by 50 basis points. Nvidia shares fell 1.92% underperforming market, Apple shares rose 1.8% on Wednesday while Morgan Stanley revised its outlook for Apple’s share price down to $200 in near term citing concerns around the lead time estimates for the company’s latest iPhone 16 series.

Forex news

The Dollar weakening is intact currently. The live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, slipped 0.07% on Wednesday.

Both GBP/USD and EUR/USD reversed their sliding yesterday while Office for National Statistics data showed UK inflation was unchanged from July and in line with expectations. Both Pound and euro are higher against the dollar currently. USD/JPY reversed its advancing while AUD/USD continued its climbing on Wednesday with the yen lower against the Greenback currently and the Australian dollar higher still.

Stock Market news

The US stock index futures are up currently ahead of unemployment claims report due at 16:30 CET today. US stocks closed lower on Wednesday with the three main US stock benchmarks recording daily losses in a narrow range from -0.3% to -0.25% after the Federal Reserve announced an interest rate cut of half a percentage point while Fed chair Jerome Powell said “the US economy is in good shape.”

European stock indexes futures are rising currently after closing down on Wednesday as food and beverage shares led losses. Bank of England is meeting today and it is widely expected to stand pat. Asian stock indexes futures are rising today with Hong Kong’s Hang Seng Index leading gains.

Commodity Market news

| Brent Crude Oil | --- | --- | --- |

| Cotton | --- | --- | --- |

Brent is retracing higher presently. Prices ended lower yesterday despite the Energy Information Administration report of above-expected draw in US crude oil inventory of 1.6 million barrels last week while gasoline and distillate inventories rose slightly. The US oil benchmark West Texas Intermediate (WTI) futures slid 0.4% but are higher currently. Brent crude slipped 5 cents to $73.65 a barrel on Wednesday.

Gold Market News

| Gold USD | --- | --- | --- |

Gold prices are rebounding presently. Spot gold extended losses 0.4% to $2559.30 an ounce on Wednesday.

Crypto

| Bitcoin | --- | --- | --- |

| Ethereum - Dollar USA | --- | --- | --- |

News

GM and Ford Are Pulling Back From EVs

General Motors and Ford are quietly stepping back from the aggressive EV plans they were pushing just a few years ago. This...

PayPal Partners with OpenAI and Applies to Become a Bank

PayPal has been under a lot of pressure for a while now: there was a rising doubt if paypal can even still compete with Apple...

The Road to Hell is Paved with Good Intentions: 10% Credit Card Interest Rate Cap

As of January 2026, there is a proposal to cap credit card interest rates at 10% nationwide. The idea is to help Americans...

Iran Currency Collapse and BRICS Stress Test

So, here is what we have; Iranian Rial basically collapsed in early 2026. And it’s happening because the currency is failing,...

How Big Corporations Legally Avoid the 21% Tax

The U.S. corporate tax rate is officially 21%. In theory, that is what profitable companies are supposed to pay. But in practice,...

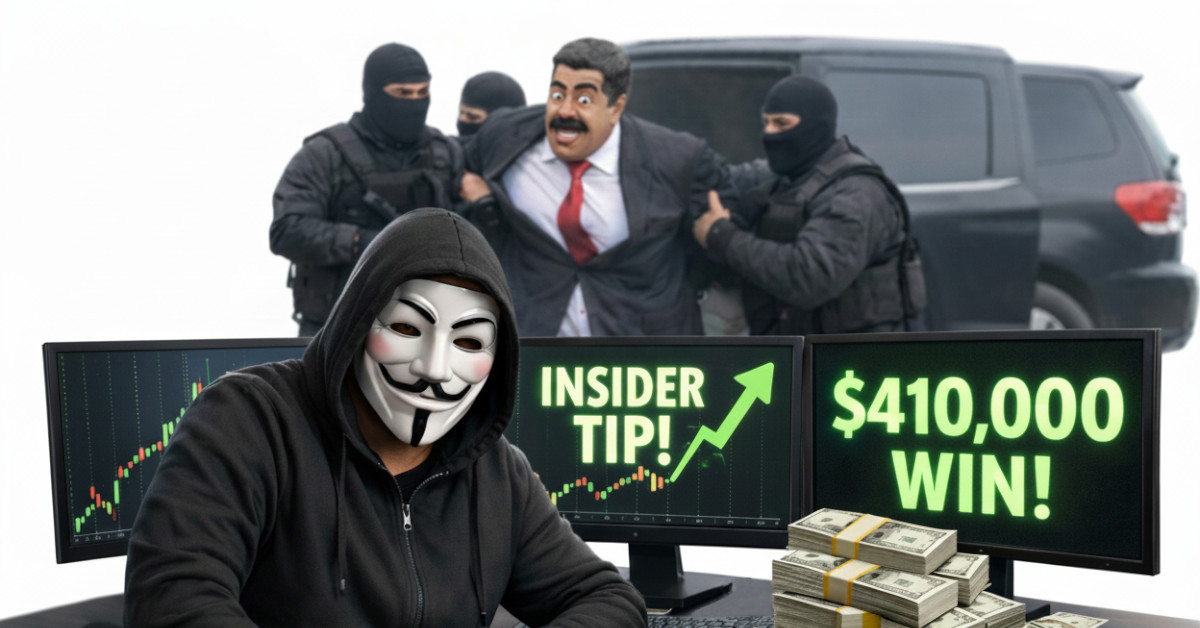

Trader Makes $410,000 Betting on Maduro’s Removal

An unknown slick trader made $410,000 in profit by betting that Venezuelan President Nicolas Maduro would be ousted (kidnapped...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also