- Analytics

- Market Overview

USD JPY Is Сonsolidating Around 100 - 22.7.2013

News

How Big Corporations Legally Avoid the 21% Tax

The U.S. corporate tax rate is officially 21%. In theory, that is what profitable companies are supposed to pay. But in practice,...

Trader Makes $410,000 Betting on Maduro’s Removal

An unknown slick trader made $410,000 in profit by betting that Venezuelan President Nicolas Maduro would be ousted (kidnapped...

Stablecoin Supercycle - A Threat to Traditional Banking

The rise of stablecoins could change how global finance works. What started as a market worth about $200 billion is expected...

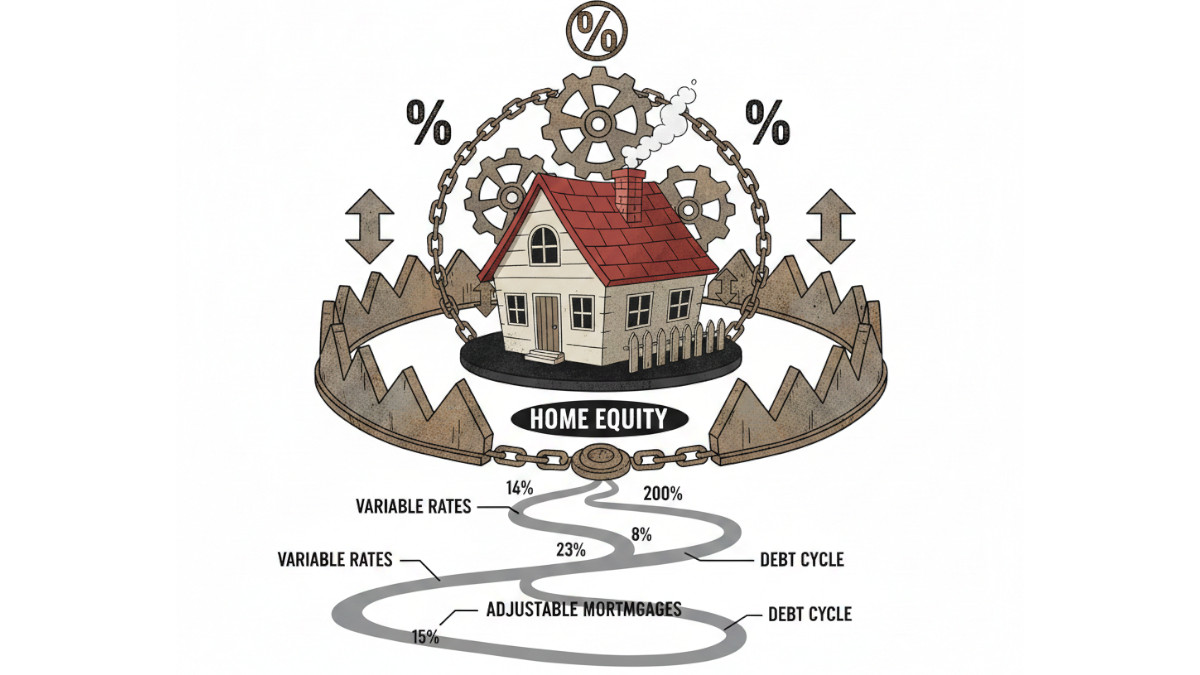

The 2026 Rate Trap

The Federal Reserve just cut interest rates for the third time, bringing them to a range of 3.50% - 3.75%. However, investors...

AI That Steals Faster Than You Can Audit

The era of manual auditing in DeFi is ending. GPT-5 and Claude's can autonomously identify and exploit vulnerabilities in...

Oil Stocks and OPEC’s Credibility Problem

At the end of November, OPEC announced it would keep oil production flat through the first quarter of 2026. Historically,...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also