- Analytics

- Market Overview

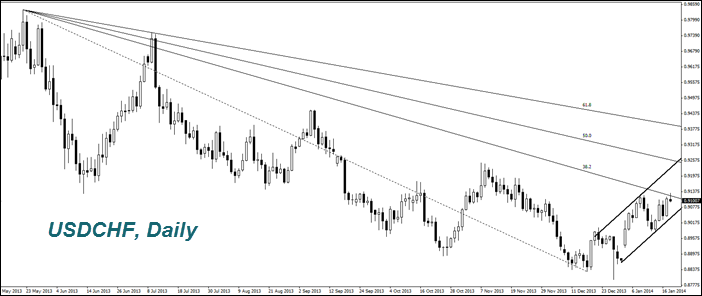

It is difficult to say about the probability of the «abenomics» session for the Swiss franc - 20.1.2014

The Swiss Franc (USDCHF) weakened by 2.5% (an increase in the chart). Now, a number of economists believe that this trend will continue to reach 0.98 francs per dollar by the year-end . According to them, previously in the period (2007-2012) the Swiss Franc and Japanese Yen strongly strengthened due to low rates and carry trade policies. Later, the yen has fallen sagnificantly against the dollar (an increase in the chart) and reached more than adequate level due to the redemption of government bonds by the Bank of Japan. Thus the Japanese agovernment have struggled with possible deflation. The “Abenomics” term arose by the name of Japanese Prime Minister Shinzo Abe. It is difficult to say about the probability of the «abenomics» session for the Swiss franc. However, it should be noted that due to the actions of the Bank of Japan, the weakening of the yen against the U.S. dollar in 16 months was about 36%. During the same time, the Swiss franc, in contrast, rose by 2%. Meanwhile, there is a risk of deflation or Swiss economy. Theoretically, this may require a change in the monetary policy of the Swiss National Bank. However , its next meeting is to be held not sooner than March 20. In the meantime, we will track other events relating to the Swiss franc. The next important economic data is expected on January 30 (KOF indicator ) . The Australian Dollar (AUDUSD) was on a slight correction after the strong attenuation. This was facilitated by the data on growth in the Chinese economy by 7.7% for the last year. Note that the increase in Chinese GDP for October-December was 1.8% less than the preliminary forecasts. This limited the strengthening of Aussie. On Wednesday, this week ,we expect the macroeconomic data on inflation in Australia that could affect its national curency rate. Neat release (GMT+0, Greenwich): 11:00

Questions and suggestions:[email protected]

News

JPMorgan Data Fees And Why Europe’s PSD2 Got It Right

When Bloomberg and Reuters reported that JPMorgan Chase plans to charge fintech companies for access to customer bank-account...

DOGE Shutdown

Elon Musk and Donald Trump nicely leveraged public ignorance around the Department of Government Efficiency (DOGE) and Dogecoin...

Copper Price Analysis

Copper, often referred to as the metal of civilization, plays a pivotal role in various industries, including construction,...

Soybeans Price Analysis - Trends and Drivers

Soybeans have experienced significant price fluctuations over the past decades. From the 1970s through the early 2000s, soybean...

Warren Buffett Adds $521 Million to Chevron

Berkshire Hathaway made one of its biggest stock purchases last quarter, adding nearly $521 million worth of Chevron (CVX)...

BTCUSD Analysis: Trump Walked Back Massive Tariffs on China

On Monday, Bitcoin stabilized at $115,000 after last week's sharp selloff, as Trump backed down on his threat to impose massive...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also