- Analytics

- Market Overview

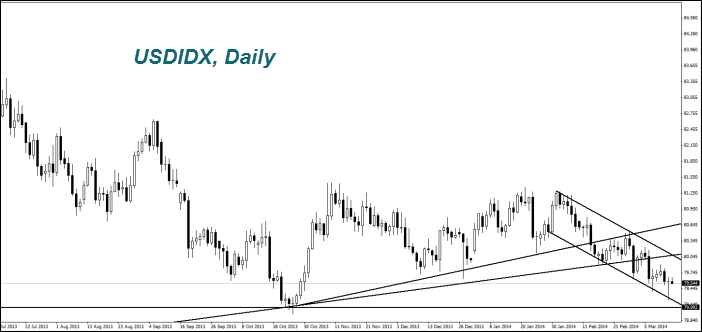

The U.S. Dollar Index rose due to good macroeconomic data from the U.S. - 14.3.2014

The ECB President, Mario Draghi had another interview. This time he said that although the deflation risk is strongly limited now, the longer the inflation is at a low level, the greater the likelihood of deflation is. Draghi added that the ECB is preparing a nonstandard monetary policy to control inflation and it is ready to fight deflation. After that, Forex market participants decided that the ECB could still start monetary emission. This caused a slight weakening of the Euro (fall on the EURUSD chart).

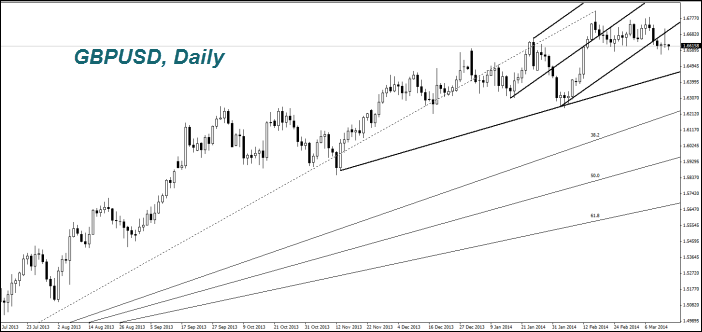

As we noted in the previous review, the British Pound (GBPUSD) looks weaker than the Euro now. Today at 9-30 GMT, the Foreign Trade data for January will strike out in the UK. In our opinion, the preliminary forecasts are negative. The weakening of the Pound (fall on the chart) can continue if they coincide with the reality. The Japanese Yen greatly strengthened yesterday as investors see it as a safe heaven asset amid slowing down in Chinese economy. It looks like the fall on the USDJPY chart. Meanwhile, the Bank of Japan increased its possible monetary issue for this year from $60trn. Yen up to 70trn. Yen. Due to the growth of the sales tax from April 1st, the Japanese GDP is expected to fall by 3.8% in the second quarter of this year. Due to these factors, as well as the Bank of Japan inflation target (2 %), some Forex market participants believe that the rate may reach 107 Yen per Dollar by the middle of the year. The cost of soybean (Soyb) fell after China refused to buy 600 tons in South America. The reason was the huge scaled bird flu outbreak in the Guangdong province. Recall that the soybean share in the feed of poultry may exceed 20%. The Wheat fell after the USDA reporting of reduction in export of last year's harvest within the week, from March 6th to 477 tons. This is 14% lower compared to the previous week and 46% lower compared to the same period of last year. Exports of maize (Corn) decreased from 1.52 million tons to 683 thousand tons and soybeans - from 773 thousand tons to 113.5 thousand tons.

The U.S. Senate Banking Committee approved the liquidation of the Freddie Mac and Fannie Mae mortgage companies. They should be replaced by the Federal Mortgage Insurance Corporation. Shares of the companies fell by about 35%. We do not exclude the negative impact of this event on the American stock insurer (American International Group Inc). During the crisis in 2008, all three companies were actually rescued by government loans. Probably, Freddie Mac and Fannie Mae were unable to pay them off. Of course the AIG is in a much better position. Late last month Fitch even raised its credit rating. However we believe that most of the money will be diverted from AIG to development and debt payment.

News

Will Gold Keep Rising

Since 2020 gold price climbed more than 230% at the same time central banks started one of the biggest buying waves in decades....

TikTok is Being Gutted for AI Data and Advertisers

TikTok is no longer the company it once was. From a creator centric social hub it turned into a data collecting and selling...

S&P 500 Outlook: Valuations, Real Yields, and the AI Hype

S&P 500, as we all have been saying too many times, is moving mostly because of a small group of very large tech companies...

Crypto Liquidations Domino Effect

Crypto market just went through a sharp sell-off over the weekend Bitcoin briefly fell below key support level before bouncing...

Paramount Skydance is After CNN

Paramount Skydance is going after Warner Bros. Discovery. They’ve filed a lawsuit in Delaware and are getting ready to...

GM and Ford Are Pulling Back From EVs

General Motors and Ford are quietly stepping back from the aggressive EV plans they were pushing just a few years ago. This...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also