- Analytics

- Market Overview

Good statistics on the U.S. labor market testifies of the economic recovery - 4.7.2014

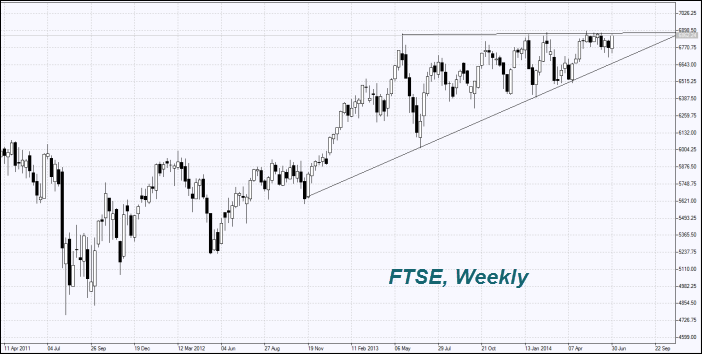

Global stock indices have increased markedly on Thursday. Market participants believe that the good statistics on the U.S. labor market testifies of the global economic recovery. They hope that the increase in interest rates could begin in the third quarter of 2015.

The U.S. Nonfarm payrolls increased in June by 288 thousand jobs. Unemployment fell to the lowest since September 2008, and was 6.1%. Unemployment among those who can not find a job for 27 weeks (longer than 30 months) fell to its lowest level since February 2009 and was 2%. In the first half of this year, the average employment growth totaled 231 thousand per month. This is the best figure since 2006. Thanks to such information, the Dow and S&P 500 reached highs yesterday for the third time in a row. However, not all of investors are confident about the "rally" continuation.The trading volume on the U.S. exchanges was very small yesterday, about 40% below the monthly average and was only 3.5 billion shares. Today is the Independence Day in the United States.

European stocks rose yesterday due to the positive ECB statements, as well the U.S. indices. Interest rates have not changed. The ECB President, Mario Draghi said that the soft monetary policy to stimulate the economy will continue despite a possible increase in inflation. If necessary, his department is ready to proceed to the single currency emission. According to the ECB, it is too expensive now vs. other currencies and may damage the EU economy. Also this should increase inflation in the EU up to the level of 2% from the current 0.5%. Today, European stocks are likely to trade in a neutral trend. Since the EU is not expected to release any significant economic data and the U.S. markets are closed.

The Nikkei has grown together with other world stock indices. An additional positive was the news about individual companies such as Panasonic, Seven & i Holdings and Honda Motor. On Monday morning at 5-00 CET, we expect two economic indicators for May to be released in Japan. The forecast, in our opinion, can be positive.

China held another Corn auction from the state reserves. It was proposed 5 million tons to be sold - 1.56 million tons at $340-$360 per ton. Recall that the sale of Chinese reserves began on May 22nd. During this time, there were about 9.1 million tons of maize sold. Its overall strategic reserves in China are estimated at 100 million tons, which covers the six-month consumption in the country. Earlier, the authorities have stated that they intend to sell only 15 million tons. Since the beginning of May, when the drought ended in the United States and the first reports on the implementation of China's reserves appeared, the Corn prices dropped by more than 20%.

Note that the grain prices keep falling by reducing the drought risk in the United States. Generally, the weather factor in July will strongly affect the quotes. In the meantime, the USDA forecasts record soybean yields in the amount of 165 bushels per acre and corn at 170 bushels per acre. The Wheat price has risen slightly due to increased demand in Egypt and Indonesia.

The Coffee exports from Peru in the second quarter has fallen by 67% compared to the same period in 2013 due to a fungal disease of coffee trees. The exports for June amounted to only 3.2 tons. This is the fifth part of June last year. We do not exclude that this message can support the quotes. Despite the fact that Peru is growing only 3% of the world coffee crop, is the eighth country in the world by its production.

The Gold prices are showing remarkable stability amid rising global stock markets and the negative news. Perhaps there are large unknown buyers at the market. Yesterday we noted the news from India, and today - from China. Last week, the Chinese National Audit Office announced the possible falsification of credit transactions secured by the Gold $15.2 billion worth. Recall that learning about the commodity mortgage loans conditions in China has begun along with investigation of the Qingdao port fraud. Some market participants fear tightening of lending rules, which may lead to a drop in gold imports to China by about a quarter, or 300-400 tons this year.

News

Hormuz Bottleneck

The Strait of Hormuz, just 21 miles wide at its narrowest point, is currently closed. Through this corridor flows roughly...

Iran Secret Overture to the CIA

A day after US and Israeli strikes began raining down on Iranian territory, operatives from Iran Ministry of Intelligence...

Why China Wins When Oil Prices Spike

Key Takeaways The Paradox - China's import dependence doesn't translate to vulnerability The Stockpile Advantage - the 1.13-2M...

Will Gold Keep Rising

Since 2020 gold price climbed more than 230% at the same time central banks started one of the biggest buying waves in decades....

TikTok is Being Gutted for AI Data and Advertisers

TikTok is no longer the company it once was. From a creator centric social hub it turned into a data collecting and selling...

S&P 500 Outlook: Valuations, Real Yields, and the AI Hype

S&P 500, as we all have been saying too many times, is moving mostly because of a small group of very large tech companies...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also