- Analytics

- Market Overview

Dollar weakened against other currencies - 22.5.2015

Nikkei has been rising for 6 straight days — the longest winning streak since December. The index has been traded close to the maximum since December, 1989. The growth is boosted by Bank of Japan, which decided today to keep money emission at the current level (80 trn yen). It is worth mentioning that good Q1 GDP data were issued on Wednesday. Investors praise governmental economic policy, known as “Abenomics”. Today Bank of Japan stated the program would continue and expressed confidence that inflation will reach the 2% goal in 6 months. The yen weakened because market participants expected the policy would remain unchanged. Yet, the Japanese currency strengthened on positive GDP report. Altogether, the yen have been traded in a range for 6 months, which may result in a quick and sharp momentum.

Wheat and corn futures rose due to bad weather forecasts in the US. Soybean prices have been traded lower after Agroconsult agency (Brazil) raised crops forecast to record-high 96.1mln tons.

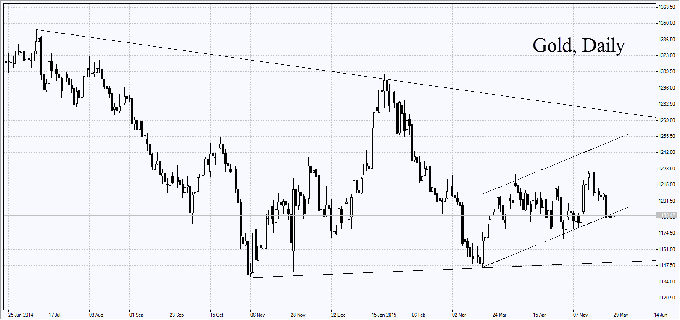

Gold has slightly pulled back but has still been above the key level of $1200 per ounce. According to Thomson Reuters' Lipper, investors withdrew $597mln from American precious metals funds — the biggest amount since December, 2013.

News

JPMorgan Data Fees And Why Europe’s PSD2 Got It Right

When Bloomberg and Reuters reported that JPMorgan Chase plans to charge fintech companies for access to customer bank-account...

DOGE Shutdown

Elon Musk and Donald Trump nicely leveraged public ignorance around the Department of Government Efficiency (DOGE) and Dogecoin...

Copper Price Analysis

Copper, often referred to as the metal of civilization, plays a pivotal role in various industries, including construction,...

Soybeans Price Analysis - Trends and Drivers

Soybeans have experienced significant price fluctuations over the past decades. From the 1970s through the early 2000s, soybean...

Warren Buffett Adds $521 Million to Chevron

Berkshire Hathaway made one of its biggest stock purchases last quarter, adding nearly $521 million worth of Chevron (CVX)...

BTCUSD Analysis: Trump Walked Back Massive Tariffs on China

On Monday, Bitcoin stabilized at $115,000 after last week's sharp selloff, as Trump backed down on his threat to impose massive...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also