- Analytics

- Market Overview

US stocks pull back on tax cut phase-in talk - 31.10.2017

Federal Reserve two-day policy meeting starts

US stocks retreated on Monday after a report that the House of Representatives is considering phasing in a cut to corporate taxes rather than enacting them immediately. The dollar pulled back after hefty gains last week: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.4% to 94.527. S&P 500 closed 0.3% lower settling at 2572.83 led by health care shares. The Dow Jones industrial average lost 0.4% to 23348.74. The Nasdaq composite index lost 2.3 points to 6698.96.

Treasury yields retreated after reports President Trump is leaning toward Federal Reserve Governor Jerome Powell as the next head of the central bank. Powell is perceived a dovish nominee compared to Stanford economist John Taylor who is expected to favor more aggressive interest rate increases. Trump is expected to announce his decision on Thursday. A Bloomberg report that the House is discussing a “gradual phase-in for the corporate tax-rate cut that President Donald Trump and Republican leaders want — a schedule that would have the rate reach 20 percent in 2022” undermined investors risk appetite. White House said President Trump had not changed his principles on tax overhaul and his plan didn’t include a phase in. In economic news personal consumption expenditure index, the Fed’s preferred inflation gauge, rose 0.4% as consumer spending jumped 1% in September, the biggest gain since 2009. Today Federal Reserve two day policy meeting starts.

European stocks edge higher

European stocks ended higher on Monday after the central government in Madrid dissolved Catalonia’s government and decreed direct rule over the region. The euro and British Pound retraced higher against the dollar. The Stoxx Europe 600 index ended 0.1% higher. The DAX 30 added 0.1% to 13229.57. France’s CAC 40 ended marginally lower and UK’s FTSE 100 lost 0.2% to 7487.81. Indices opened mixed today.

Spanish stocks recovered as Prime Minister Mariano Rajoy set new legislative elections in Catalonia for December 21. Economic data were mixed: Spain’s Q3 GDP rose 0.8% over quarter, in line with expectations, and Germany’s retail sales for September beat expectations but consumer price inflation for October came in lower than expected.

Bank of Japan keeps monetary policy steady

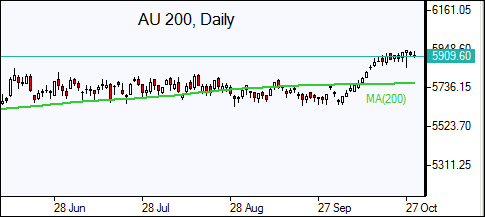

Asian stock indices are mostly lower today. Nikkei closed 0.04% lower at 22002.50 as the Bank of Japan kept monetary policy steady and yen was little changed against the dollar. The central bank maintained its inflation forecasts pointing to signs of growing strength in the economy that policymakers hope will accelerate inflation towards its 2% percent target. Chinese stocks are higher despite a report China's factory activity expansion slowed: the official manufacturing purchasing managers' index fell to 51.6 in October from 52.4 in September. The Shanghai Composite Index is 0.1% higher while Hong Kong’s Hang Seng Index is down 0.1%. Australia’s All Ordinaries Index is down 0.2% while Australian dollar is flat against the greenback.

Oil edges lower

Oil futures prices are inching lower today as traders took profits with recent gains raising the likelihood of increased US shale oil output boosted by higher prices. Prices rose Monday on continued optimism about global market rebalancing following talks of possible extension of OPEC output cut deal beyond March 2018. December Brent crude rose 0.8% settling at $60.90 a barrel on Monday.

News

JPMorgan Data Fees And Why Europe’s PSD2 Got It Right

When Bloomberg and Reuters reported that JPMorgan Chase plans to charge fintech companies for access to customer bank-account...

DOGE Shutdown

Elon Musk and Donald Trump nicely leveraged public ignorance around the Department of Government Efficiency (DOGE) and Dogecoin...

Copper Price Analysis

Copper, often referred to as the metal of civilization, plays a pivotal role in various industries, including construction,...

Soybeans Price Analysis - Trends and Drivers

Soybeans have experienced significant price fluctuations over the past decades. From the 1970s through the early 2000s, soybean...

Warren Buffett Adds $521 Million to Chevron

Berkshire Hathaway made one of its biggest stock purchases last quarter, adding nearly $521 million worth of Chevron (CVX)...

BTCUSD Analysis: Trump Walked Back Massive Tariffs on China

On Monday, Bitcoin stabilized at $115,000 after last week's sharp selloff, as Trump backed down on his threat to impose massive...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also