- Analytics

- Market Overview

US stocks slip despite upbeat earnings - 10.5.2017

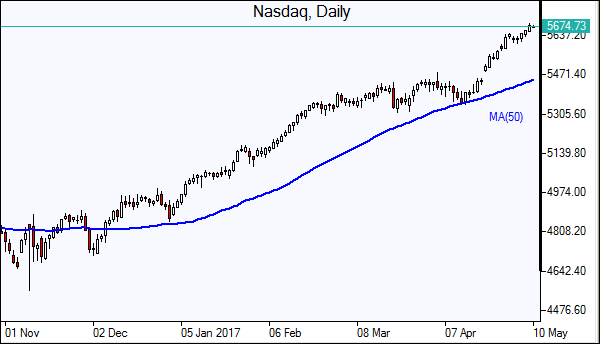

Nasdaq hits another record

US stocks ended lower on Tuesday despite mostly upbeat earning reports as energy stocks fell with lower oil prices. The dollar continued strengthening as comments by central bank officials indicated Federal Reserve will implement the policy of gradual rate hikes: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, ended 0.4% higher at 99.533. Dow Jones industrial average lost 0.2% to 20975.78, led by Chevron and Cisco shares, down 1.5% and 1.1% respectively. The S&P 500 slipped 0.1% settling at 2396.92 with seven of the 11 main sectors finishing in the red, led by utilities, energy and materials stocks. The Nasdaq index rose 0.3% to 6120.59, its 30th closing record of the year.

The bull market continues with Trump reflation trade appearing intact on expectations of stimulus measures such as tax cuts. With roughly three out of four companies that have reported quarterly results so far beating analysts' expectations according to Thomson Reuters data, estimated Q1 earnings growth is now at 14.5%, highest since Q3 of 2011. Stock indices are trading in narrow range recently with no new economic data providing a boost to market sentiment as stocks are trading at high valuation levels. Job openings in March declined compared with previous month, and wholesale inventories rose 0.2% in March. Kansas City Fed President Esther George said the central bank should still stick to gradually raising rates despite some signs of weaker economy. Today at 14:30 CET April Import and Export Price Indexes will be published, the tentative outlook is negative for the dollar.

European stocks advance on record German trade data

European stocks advanced on Tuesday on the back of increased risk appetite after centrist Emmanuel Macron won France’s presidential election, with better than expected German trade data providing additional boost. Both the euro and British Pound slipped against the dollar. The Stoxx Europe 600 added 0.5%. Germany’s DAX 30 gained 0.4% closing at a fresh record 12749.12. France’s CAC 40 rose 0.3% and UK’s FTSE 100 outperformed advancing 0.6% to 7342.21, a fourth consecutive gain.

Investor risk appetite was buoyed as German exports hit a record €118.2 billion in March, up 0.4% with imports rising 2.4% to €92.9 billion. At the same time German Destatis statistics office reported German industrial output declined 0.4% seasonally adjusted, less than an expected 0.7% decline. Today at 13:00 CET ECB president Draghi will speak in Dutch Parliament.

Asian stocks up

Asian stock indices are higher today as US Commerce Secretary Wilbur Ross signaled the Trump administration would attempt to use existing tools to aggressively enforce trade rules and insist on fairer treatment for US goods, instead of measures like border adjustment tax. Ross said the Commerce Department is working on some "self-initiated" anti-dumping and anti-subsidy cases on behalf of private industries that could help shield them from unfairly traded imports. Nikkei rose 0.3% to 17 month high 19900.09 as yen slide against the dollar continued. Chinese shares are lower as producer price inflation cooled more than expected while consumer inflation edged up in April: Shanghai Composite Index is 0.9% lower, while Hong Kong’s Hang Seng Index is 0.6% higher. Australia’s All Ordinaries Index is up 0.6% as Australian dollar rebounded against the greenback.

Oil prices up ahead inventory data

Oil futures prices are edging higher today after the American Petroleum Institute report late Tuesday US crude oil inventories fell by 5.8 million barrels last week instead of expected 1.8 million barrels decline. Prices fell yesterday after the US government raised its forecast on domestic crude output for this year and next, and cut its 2017 price outlook. July Brent crude closed 1.2% lower at $48.73 a barrel on London’s ICE Futures exchange on Tuesday. Today at 16:30 CET the Energy Information Administration will release US Crude Oil Inventories.

News

Why China Wins When Oil Prices Spike

Key Takeaways The Paradox - China's import dependence doesn't translate to vulnerability The Stockpile Advantage - the 1.13-2M...

Will Gold Keep Rising

Since 2020 gold price climbed more than 230% at the same time central banks started one of the biggest buying waves in decades....

TikTok is Being Gutted for AI Data and Advertisers

TikTok is no longer the company it once was. From a creator centric social hub it turned into a data collecting and selling...

S&P 500 Outlook: Valuations, Real Yields, and the AI Hype

S&P 500, as we all have been saying too many times, is moving mostly because of a small group of very large tech companies...

Crypto Liquidations Domino Effect

Crypto market just went through a sharp sell-off over the weekend Bitcoin briefly fell below key support level before bouncing...

Paramount Skydance is After CNN

Paramount Skydance is going after Warner Bros. Discovery. They’ve filed a lawsuit in Delaware and are getting ready to...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also