- Analytics

- Market Overview

Fed Rate Cut & AI's Next Wave: How Lower Rates Will Fuel the Tech Boom - 8.12.2025

Todays’ Market Summary

- Fed rate cut put the live dollar index under pressure

- Bitcoin soared toward the $90,000 level

- Global stock markets had a strong week

- Both Brent Crude and WTI gained

- Gold prices continued an impressive long term bullish trend

Top daily news

The most important news of the week centered around expectations for an interest rate cut by the U.S. Federal Reserve next week. Fed will likely deliver a third consecutive rate cut. A secondary but also important news is the continued boom in AI related investment, which helped the technology sector show strong gains globally. However, this growth is shadowed by concerns over sticky inflation and the sustainability of record U.S. fiscal deficits.

Forex news

Fed rate cut put the live dollar index under pressure, causing it to retreat from a key support area. Traders are actively pricing in dollar weakness, although the downward momentum has been contained as the market awaits the official Fed announcement and forward guidance.

EUR/USD and GBP/USD: Both pairs showed strength against the softer US Dollar. GBP/USD was highlighted by analysts as the preferred market for dollar-weakness, demonstrating a clearer pattern of higher highs and higher lows, breaking out toward a major resistance zone around 1.3350. EUR/USD also showed bullish signs, holding above a key level, though its trend was less decisive than the British Pound's.

USD/JPY: The pair pulled back this week, primarily due to rising speculation that the Bank of Japan (BoJ) might signal a rate hike later this month. This has led to the Japanese Yen gaining strength, breaking its typical correlation with U.S. interest rates. The pair is now entering a critical week with the focus split between the Fed's decision and the BoJ's potential policy shift.

AUD/USD: The Australian Dollar has been ripping higher toward resistance, benefiting from the generally weaker US Dollar, but analysts caution that exhaustion risk might be building after the sharp move.

Stock Market news

Global stock markets had a strong week, based on optimism for lower interest rates and the resurgence of the AI theme.

Dow Jones Index, Nasdaq Index, and S&P 500 Index: U.S. stock benchmarks traded consistently near their all-time highs. The S&P 500 Index and the Nasdaq Index led the charge, with tech stocks seeing a bounce back, confirming the strong interest in AI-related companies. The Dow Jones Index also posted solid gains, reflecting broad market confidence.

Nikkei rallied significantly, climbing over 2% and nearing its own all-time high. This was driven by the global rate-cut expectations, even as the possibility of a domestic rate hike by the Bank of Japan created some uncertainty.

Hang Seng index reversed earlier losses to end the week in positive territory, with gains largely concentrated in the technology and consumer sectors.

Australian Stock Index ended the week with minor gains, recovering from earlier slumps. Sector performance was mixed, with materials and energy stocks leading the gainers, while real estate and consumer staples lagged.

Commodity Market news

| Brent Crude Oil | --- | --- | --- |

| Cotton | --- | --- | --- |

Both Brent Crude and WTI gained, with WTI settling above the key $60 per barrel mark. This upward move was largely attributed to a "risk premium" persisting in the market due to the murky outlook for a cease-fire in the Russia-Ukraine conflict, which includes attacks on key Russian infrastructure. Analysts also noted that the move was technically driven by algorithmic traders covering bearish positions, as WTI closed above its 50-day moving average. Despite the short-term gains, the broader outlook for 2026 suggests global oil inventories will continue to rise, potentially putting downward pressure on prices, with analysts forecasting a drop toward the mid-$50s per barrel range.

Gold Market News

| Gold USD | --- | --- | --- |

Gold prices continued an impressive long term bullish trend, with the spot price for XAUUSD remaining in a strong position. The metal has been trading near its recent highs, testing the upper resistance band. The primary driver for Gold's strength is the weakening US Dollar and the widespread market belief that the Federal Reserve is about to cut interest rates. Gold's role as a safe haven, coupled with central bank gold buying sprees and ongoing geopolitical instability, has profoundly reshaped its value, with some analysts seeing a massive upward rally over the past year. However, in the short term, the price has entered a mild corrective phase as it digests its recent gains, consolidating above a key support zone around the 4200 level.

Crypto

| Bitcoin | --- | --- | --- |

| Ethereum - Dollar USA | --- | --- | --- |

Bitcoin soared toward the $90,000 level, with some analysts from major investment banks issuing "enormous" price predictions, suggesting a potential rocket to $170,000 in the coming months, primarily based on structural factors like institutional adoption. However, not all analysts share this view, with some calling the surge a "tulip bulb of our time". Ether traded lower last week, decreasing slightly but remaining above the $3,000 level, consolidating after a period of volatility.

US Dollar Index News

The Road to Hell is Paved with Good Intentions: 10% Credit Card Interest Rate Cap

As of January 2026, there is a proposal to cap credit card interest rates at 10% nationwide. The idea is to help Americans...

Stablecoin Supercycle - A Threat to Traditional Banking

The rise of stablecoins could change how global finance works. What started as a market worth about $200 billion is expected...

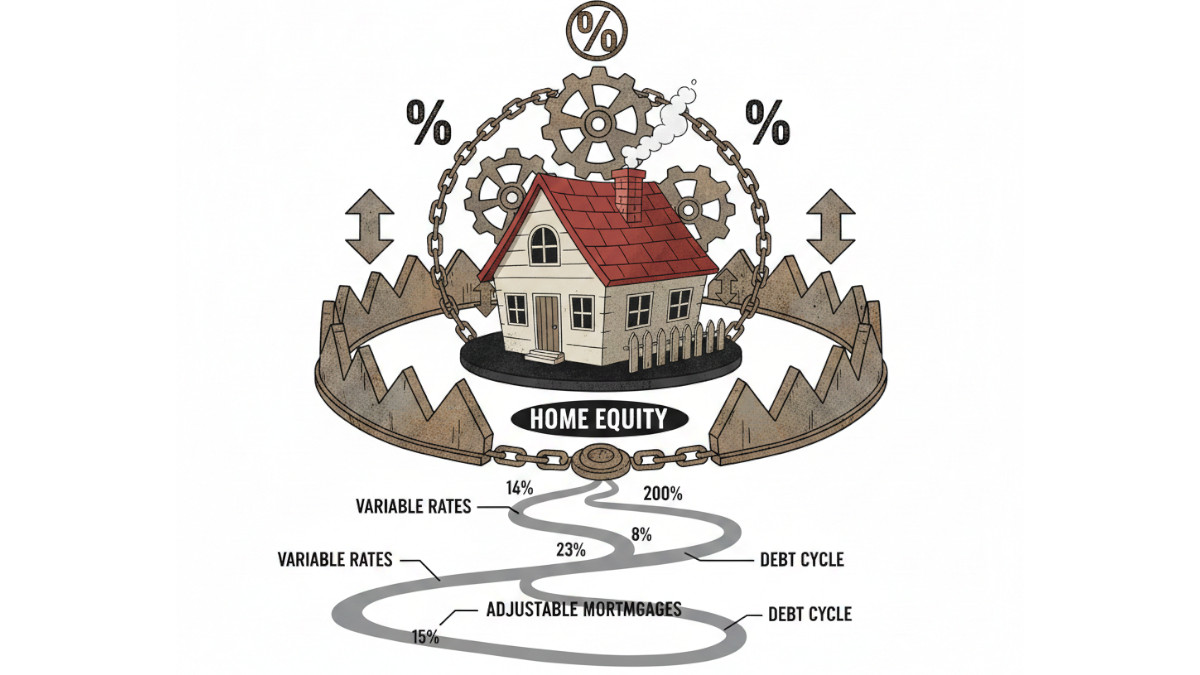

The 2026 Rate Trap

The Federal Reserve just cut interest rates for the third time, bringing them to a range of 3.50% - 3.75%. However, investors...

Dollar Soft Amid US Shutdown Risks, Jobs Report Delay

The US dollar weakened as markets responded to two developments: a potential federal government shutdown and a delay in US...

How to Trade Forex on News Releases

Why News Moves the Forex Market. In forex, prices move because of new information, more precisely, economic news. Reports...

Fed’s Waller: Rate Cut Needed Soon

Federal Reserve Governor Chris Waller said it's time for the Fed to cut interest rates. In a new interview, he warned that...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also