- Analytics

- Market Sentiment

Dollar sentiment softens despite GDP upgrade

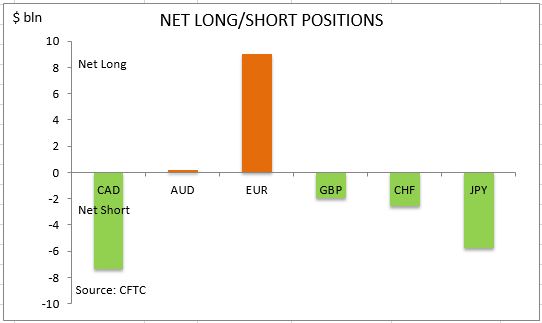

US dollar net long bets fell to $7.52 billion from $8.31 billion against the major currencies during the previous week, according to the report of the Commodity Futures Trading Commission (CFTC) covering data up May 30 released on Friday June 2. Economic data were mixed during the week with weak durable goods orders and personal consumption expenditure reports overshadowing the upgrade of second quarter US GDP growth rate.

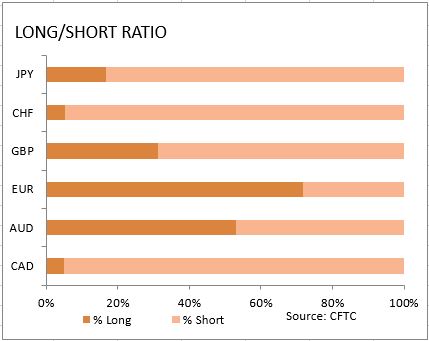

Durable goods orders fell 0.7% in April. Personal consumption expenditures price index, Federal Reserve’s preferred gauge of inflation, declined to 1.7% in April from 1.9% in March. The core PCE index though recorded a 0.2% rise after 0.1% decline the previous month. At the same time on the positive note both the personal income and spending rose 0.4% from 0.2% and 0.3% increase in March respectively. And the US Q1 GDP second estimate was revised upward to 1.2% from sluggish 0.7% advance estimate. Furthermore, May consumer sentiment by University of Michigan inched up to 97.1 from 97. However an additional negative was the 2.3% decline in existing home sales in April due to low inventory. The Fed minutes indicated the central bank plans reducing the size of its Treasurys holdings. Minutes from the May meeting of the Federal Open Market Committee showed Fed officials plan to reduce the Fed’s $4.5 trillion balance sheet by gradually halting the reinvestment of principal from maturing securities. The minutes sounded cautious about the timing of next rate hike stating FOMC members agreed to await additional evidence that the recent slowing in the pace of economic activity had been transitory. As is evident from the Sentiment table, sentiment improved for all major currencies except for Japanese yen and British Pound. And the euro and Australian dollar remain the two major currencies held net long against the US dollar.

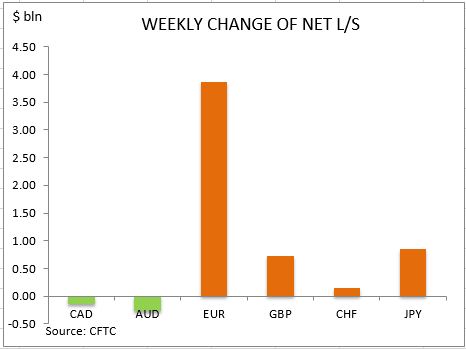

The euro sentiment improved as June Gfk consumer confidence index inched higher while May headline inflation declined to 1.5% from 2% in Germany. The net long euro position rose at about one third of last week’s pace by $1.12bn to $10.18bn. Investors built the gross longs and cut shorts by 1194 and 6830 contracts respectively. The British Pound sentiment deteriorated as the net short position in British Pound widened $0.44 bn to $2.37bn as investors cut the gross longs and built shorts by 3592 and 2199 contracts respectively. The bearish Japanese yen sentiment intensified slightly despite an 0.1% inflation rise on month in April following a 0.1% decline in March and pick up in retail sales to 1.4% on month after 0.2% growth in previous month. The net short position in yen widened $0.12bn to $5.9bn. Investors built both the gross longs and shorts by 1484 and 2103 contracts respectively.

The Canadian dollar sentiment showed signs of improvement as the Bank of Canada left interest rate at 0.5% while the March budget balance turned into 10.4 billion Canadian dollars deficit from 1.3 billion surplus in February and first quarter current account deficit rose compared with Q4 2016. The net short Canadian dollar position narrowed $44 million to $7.3bn. Investors cut both the gross longs and shorts. The bullish Australian dollar sentiment didn’t change much with a 4.4% rise in building permits after 10.3% drop in March. The net longs rose by $32 million to $229 million. Investors built the gross longs and covered shorts. The sentiment toward the Swiss franc improved despite a decline in KOF Swiss Economic Institute leading indicators for May. The net shorts narrowed by $0.16bn to $2.37bn. Investors built both the gross longs and shorts.

CFTC Sentiment vs Exchange Rate

| May 30 2017 | Bias | Ex RateTrend | Position $ mln | Weekly Change |

| CAD | bearish | negative | -7293 | 44 |

| AUD | bullish | positive | 229 | 32 |

| EUR | bullish | positive | 10182 | 1116 |

| GBP | bearish | positive | -2371 | -438 |

| CHF | bearish | positive | -2373 | 161 |

| JPY | bearish | positive | -5895 | -120 |

| Total | -7522 |

New Exclusive Analytical Tool

Any date range - from 1 day to 1 year

Any Trading Group - Forex, Stocks, Indices, etc.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.

Last Sentiments

- 18Mar2021Weekly Top Gainers/Losers: Canadian dollar and Japanese yen

Over the past 7 days, prices for oil, non-ferrous metals and other mineral raw materials decreased but still remained high. As a result, the currencies of the commodity countries strengthened: the Canadian dollar, the Australian and New Zealand dollars, the Mexican peso, and the South African rand. The...

- 10Mar2021Weekly Top Gainers/Losers: Canadian dollar and New Zealand dollar

Оil quotes continued to rise over the past 7 days. Against this background, the currencies of oil-producing countries, such as the Russian ruble and the Canadian dollar, strengthened. The New Zealand dollar weakened after the announcement of negative economic indicators: ANZ Business Confidence and...

- 4Mar2021Weekly Top Gainers/Losers: American dollar and South African rand

Over the past 7 days, oil quotes continued to grow. Precious metals, including gold, fell in price. Against this background, the shares of oil companies increased, the Russian ruble strengthened, the Australian and New Zealand dollars, as well as the South African rand, weakened. The US dollar strengthened...