- Analytics

- Market Sentiment

US dollar bullish bets fall significantly

US dollar bullish bets fell to $20.12 billion from $24.42 billion against the major currencies during the previous week, according to the report of the Commodity Futures Trading Commission (CFTC) covering data up to January 24. Investor optimism for dollar moderated as President Trump’s first acts as he took office were seen as steps in line with his protectionist policy stance: he withdrew the US from the Trans-Pacific Partnership and promised to renegotiate trade deals.

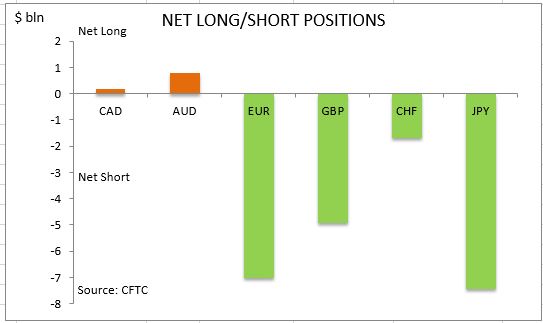

The President also met with union and business leaders and urged the chief executives of the Big Three US automakers to build more cars in the country. Economic data were mostly positive during the week. The headline inflation rose to 2.1% in December from 1.7% the previous month, core inflation edging to 2.2% over year from 2.1%. With headline inflation above the target 2% rate and unemployment at low 4.7% the Federal Reserve can raise interest rates according to its dual policy mandate unless policy makers feel they need more data to confirm US economic recovery. Other data indicated manufacturing and industrial production expanded in December, housing starts rose while building permits declined, and weekly unemployment claims, at multi-decade lows, declined further. At the same time wages gained modestly amid tight job market, according to Fed Beige Book. On the negative side existing home sales fell in December. Investors cut the dollar bullish bets for the fifth time in six weeks. As is evident from the Sentiment table, sentiment improved for all major currencies. And Canadian dollar joined the Australian dollar as the second currency held net long against the US dollar.

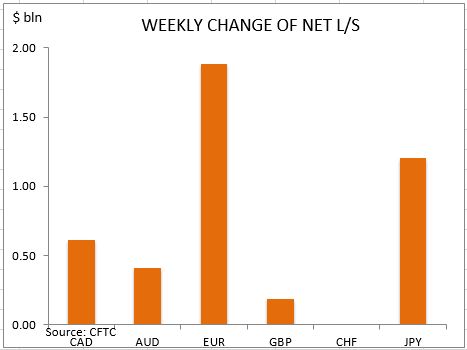

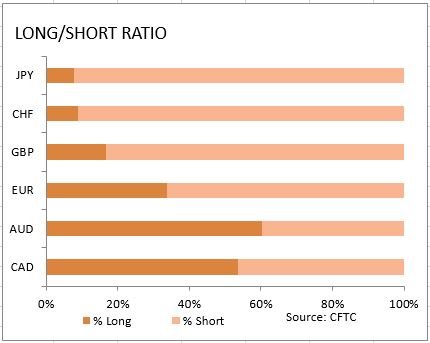

The euro and British Pound sentiment improved after concerns subsided about the possibility of UK’s hard exit from the European Union following UK’s High Court ruling that an Act of Parliament is needed before the British government can invoke Article 50, the beginning of the process for Britain to exit the European Union. The net short euro position fell by $1.8bn to $7.02bn. Investors increased the gross longs and covered shorts by 3058 and 11094 contracts respectively. The British Pound sentiment improved as Pound net shorts narrowed by $189 million to $4.95 billion. The net short position in British Pound fell as investors reduced both the gross longs and covered shorts by 3721 and 6791 contracts respectively. The Japanese yen sentiment also improved as the net short position fell $1.2bn to $7.42bn. Investors reduced both the gross longs and shorts by 1433 and 12423 contracts respectively.

The Canadian dollar sentiment turned bullish with the $418 million net short turning into a net long of $192 million against the dollar. Investors built the gross longs and covered shorts. The bullish sentiment intensified for the Australian dollar with net longs rising by $414 million to $780 million. Investors built both the gross longs and shorts. The sentiment toward the Swiss franc improved marginally with the net shorts narrowing by $4 million to $1.70bn. Investors cut both the gross longs and shorts.

CFTC Sentiment vs Exchange Rate

| January 24 2017 | Bias | Ex RateTrend | Position $ mln | Weekly Change |

| CAD | bullish | positive | 192 | 610 |

| AUD | bullish | negative | 780 | 414 |

| EUR | bearish | positive | -7021 | 1881 |

| GBP | bearish | positive | -4945 | 189 |

| CHF | bearish | positive | -1704 | 4 |

| JPY | bearish | negative | -7425 | 1202 |

| Total | -20123 |

New Exclusive Analytical Tool

Any date range - from 1 day to 1 year

Any Trading Group - Forex, Stocks, Indices, etc.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.

Last Sentiments

- 18Mar2021Weekly Top Gainers/Losers: Canadian dollar and Japanese yen

Over the past 7 days, prices for oil, non-ferrous metals and other mineral raw materials decreased but still remained high. As a result, the currencies of the commodity countries strengthened: the Canadian dollar, the Australian and New Zealand dollars, the Mexican peso, and the South African rand. The...

- 10Mar2021Weekly Top Gainers/Losers: Canadian dollar and New Zealand dollar

Оil quotes continued to rise over the past 7 days. Against this background, the currencies of oil-producing countries, such as the Russian ruble and the Canadian dollar, strengthened. The New Zealand dollar weakened after the announcement of negative economic indicators: ANZ Business Confidence and...

- 4Mar2021Weekly Top Gainers/Losers: American dollar and South African rand

Over the past 7 days, oil quotes continued to grow. Precious metals, including gold, fell in price. Against this background, the shares of oil companies increased, the Russian ruble strengthened, the Australian and New Zealand dollars, as well as the South African rand, weakened. The US dollar strengthened...