- Analytics

- Technical Analysis

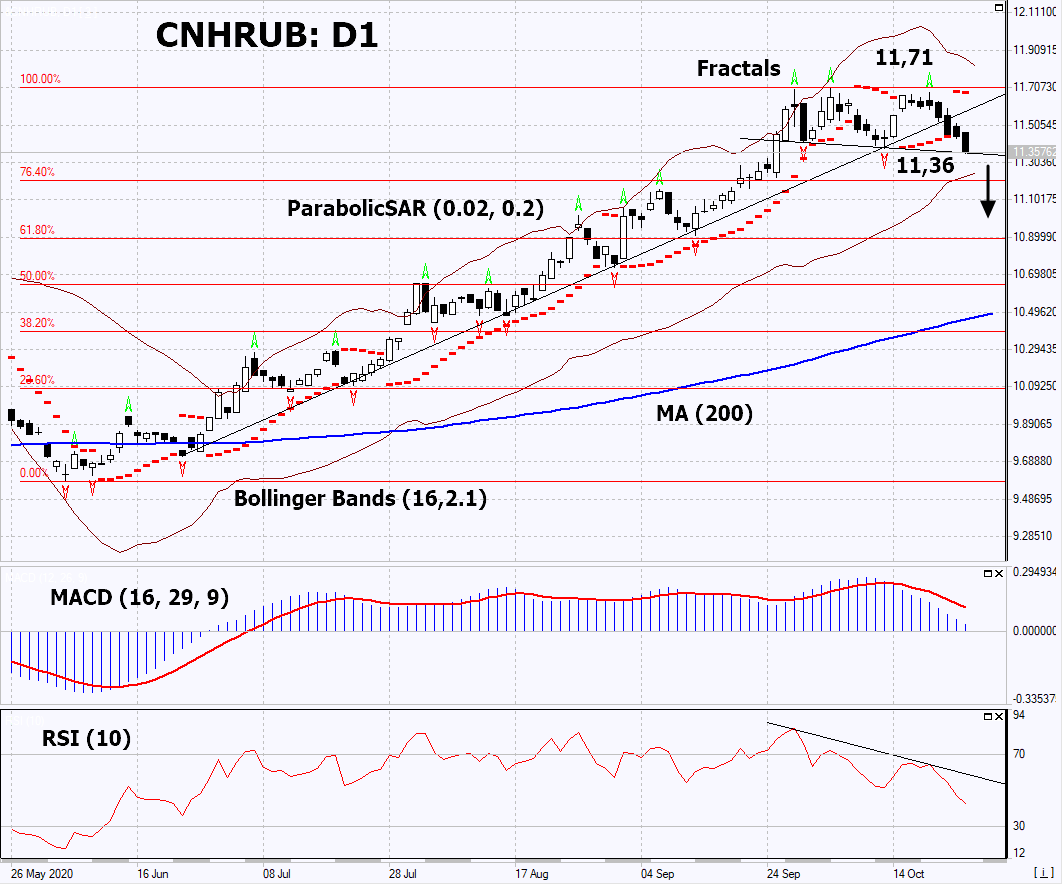

Yuan Ruble Technical Analysis - Yuan Ruble Trading: 2020-10-27

CNH RUB Technical Analysis Summary

Below 11,36

Sell Stop

Above 11,71

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Sell |

| MA(200) | Neutral |

| Fractals | Sell |

| Parabolic SAR | Sell |

| Bollinger Bands | Neutral |

CNH RUB Chart Analysis

CNH RUB Technical Analysis

On the daily timeframe, CNHRUB: D1 broke down the uptrend support line and is trying to correct downward from the maximum since February 2016. A number of technical analysis indicators generated signals for further decline. We do not rule out a bearish movement if CNHRUB falls below its latest minimum: 11.35. This level can be used as an entry point. We can place a stop loss above the maximum since February 2016, the last high fractal and the Parabolic signal: 11.71. After opening a pending order, we move the stop loss to the next fractal maximum following the Bollinger and Parabolic signals. Thus, we change the potential profit/loss ratio in our favor. After the transaction, the most risk-averse traders can switch to the 4-hour chart and set a stop loss, moving it in the direction of the bias. If the price meets the stop loss (11.71) without activating the order (11.35), it is recommended to delete the order: some internal changes in the market have not taken been into account.

Fundamental Analysis of PCI - CNH RUB

In this review, we propose to consider the "&CNHRUB" Personal Composite Instrument (PCI). It reflects the price dynamics of the Chinese yuan against the Russian ruble. Will the CNHRUB quotes continue to decrease?

The downward movement means the strengthening of the ruble and the weakening of the yuan. The Chinese currency was slightly lower amid the data on GDP growth for the 3rd quarter by 4.9% qoq, though it was expected to amount to 5.2%. Russian's current yield on 10-year government bonds is 6.2% (in rubles). In China, it is lower, at 3.2% (in yuan). Perhaps the dynamics of this PCI may depend on strengthening or softening of US sanctions against Russia or China after the US presidential election. In the meantime, Chinese authorities have expressed concern about the renminbi’s excessive rise to a 27-month maximum against the greenback. In theory, People’s Bank of China can take any steps to ease the monetary policy. The Bank of Russia, on the contrary, strives to support the ruble exchange rate. Since early 2020, it has already collapsed by almost a quarter amid falling world oil prices due to the coronavirus pandemic.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.