- Analytics

- Market Overview

Global markets remain supported by Yellen’s dovish comments - 14.7.2017

Dow hits fresh record high

US stocks advanced on Thursday as Federal Reserve Chair Janet Yellen reaffirmed the dovish stance in her testimony to Banking Committee. The dollar was little changed: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, ended at 95.758. Dow Jones industrial average added 0.1% closing at 21553.09, posting a fresh record high. The S&P 500 rose 0.2% settling at 2447.83 les by financial, energy and technology stocks. The Nasdaq index advanced 0.2% to 6274.44 for a fifth session of gains in a row.

Treasury yields rose after jobless claims data showed initial jobless claims slipped last week and producer prices rose 0.1% in June. Fed chair Yellen reiterated central bank’s plans for “gradual” increase in interest rates as the factors holding down the neutral policy stance, the rate at which economy neither accelerates nor slows, subside. Dallas Fed President Rob Kaplan on Thursday, a Federal Open Market Committee member this year, said he wants to see more evidence “that we are making progress toward meeting our 2% inflation objective in the medium term" before committing to another rate hike. However, Kaplan says the plan to reduce the balance sheet "will likely be appropriate" later this year. Another voting member of FOMC Fed Governor Lael Brainard, said on Tuesday she wanted more economic data to decide whether another rate hike was needed. Today at 14:30 CET June inflation data will be released, a decline in headline inflation is expected. A better than expected report will boost chances of another rate hike this year.

European stocks advance

European stock indices advanced on Thursday building on previous session’s gains supported by dovish comments from US Federal Reserve chief Janet Yellen interest rates don’t have to rise all that much further. The euro extended losses while < em> British Pound continued rising against the dollar. The Stoxx Europe 600 rose 0.3%. Germany’s DAX 30 added 0.1% closing at 12641.33. France’s CAC 40 rose 0.3% while UK’s FTSE 100 ended 0.1% lower at 7413.44. Indices opened higher today.

European treasury yields rose on news European Central Bank President Mario Draghi is expected to signal optimism in the euro-zone economy and reduced need for stimulus as he speaks at a conference in Jackson Hole, Wyoming. Pound advanced on hawkish comments from Bank of England policy maker Ian McCafferty who called for an early end to the central bank’s quantitative easing program. In economic news, German final inflation for June was confirmed at 1.5%, up from 1.4% in May. However, inflation in France slipped to 0.8% last month, compared with 0.9% in May.

Asian markets higher

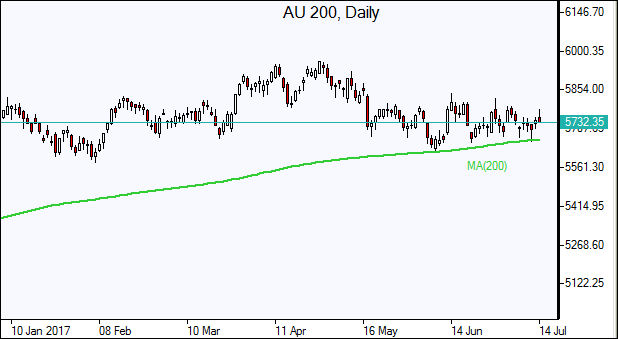

Asian stock indices are building on previous day’s gains with risk appetite buoyed by Federal Reserve Chair Janet Yellen comments that the central bank's rate hikes could be gradual. Nikkei added 0.1% to 20118.86 as yen edged lower against the dollar. Chinese stocks rising after reversing earlier losses: both the Shanghai Composite Index and Hong Kong’s Hang Seng Index are up 0.1%. Australia’s All Ordinaries Index is up 1.1% despite continued rally of the Australian dollar against the greenback.

Oil lower on rising supply concerns

Oil futures prices are edging lower today on concerns of rising global market supply. Prices ended higher Thursday on US crude inventory drop and forecast for stronger growth in demand this year. US crude inventories fell 7.6 million barrels last week. Concerns for global crude oil continued overhang intensified after reports OPEC compliance with agreed production cuts slipped to 98% percent in June while output from Libya and Nigeria is higher than at the time of the November OPEC agreement, offsetting about 60% percent of the OPEC cuts. Brent for September settlement climbed 1.4% to end the session at $48.42 a barrel on the London-based ICE Futures Europe exchange on Thursday.

See Also