- Analytics

- Market Overview

The U.S. economic data on Monday helped the USD strengthening - 15.4.2014

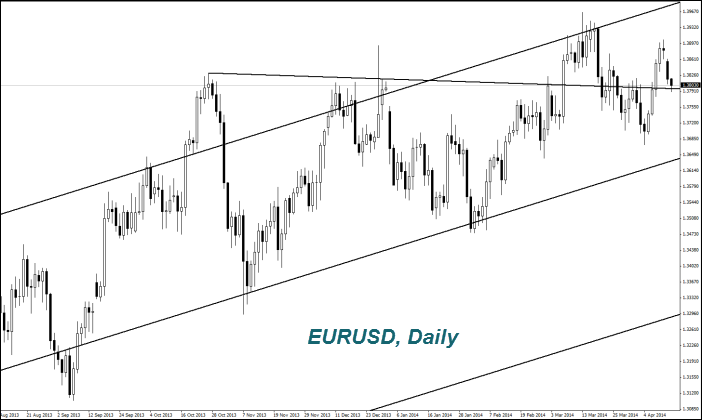

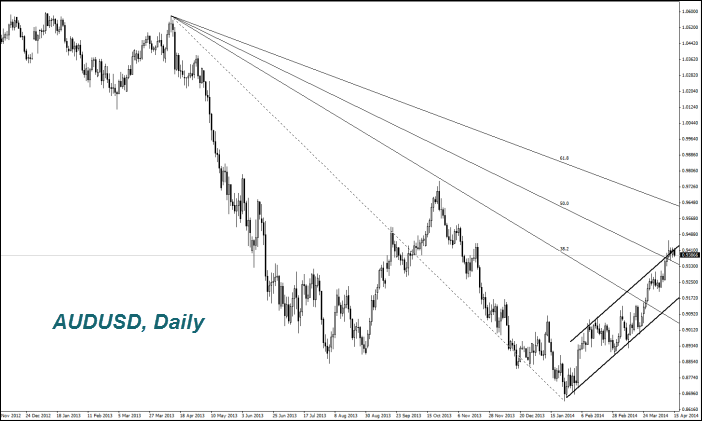

The Euro (EURUSD) demonstrated weakening (fall in the chart) after the statements by the ECB head, Mario Draghi on possible beginning of the QE new phase (money issue). Today at 13-30 CET, the ZEW index of economic activity in the EU and Germany for April and the Eurozone trade balance for February will come out. In our opinion, the preliminary forecast is positive if European investors do not submit unjustified negative emotions over Ukraine. Their opinion is taken into account while the ZEW index gets compiled. The Japanese Yen (USDJPY) remained stable thanks to the head of the Bank of Japan, Haruhito Kuroda that stated there are no plans for additional measures to mitigate the monetary policy (higher emissions). Recall that the sales tax was increased from 5% to 8% on April 1st. A significant part of market participants believed that Japan will still increase the emission volume in order to support their major corporations and increase inflation to the target level of 2% later this year. Recall that the next BOJ meeting will be held on April 30th. Tomorrow morning at 8:30 CET we will see the Industrial Production for February and the regular BOJ press conference is to be held at 10-15 CET. The Australian Dollar (AUDUSD) slightly decreased, which means its weakening. Thus investors reacted to the early April RBA meeting minutes publication. They assumed that the current level of low interest rates at 2.5% will be kept for a long time. The economic slowdown in China may be additional negative factor for the Aussie as China is the main trading partner of Australia.

Tomorrow at 6-00 CET we will find out about Chinese GDP for the first quarter. Its growth is expected to slow down to 7.3% from 7.7% in the fourth quarter. The GDP growth may slow down to 1.5% from 1.8%. This morning, we observed the negative economic information about reducing the yearly volume of new loans from the People's Bank of China by 19% and the minimal growth of the money supply. After this, the forward contracts on the Yuan fell to the lowest level of eight months. We recommend the following Chinese statistics to those traders who trade commodity futures. The weak data may trigger a downward correction.

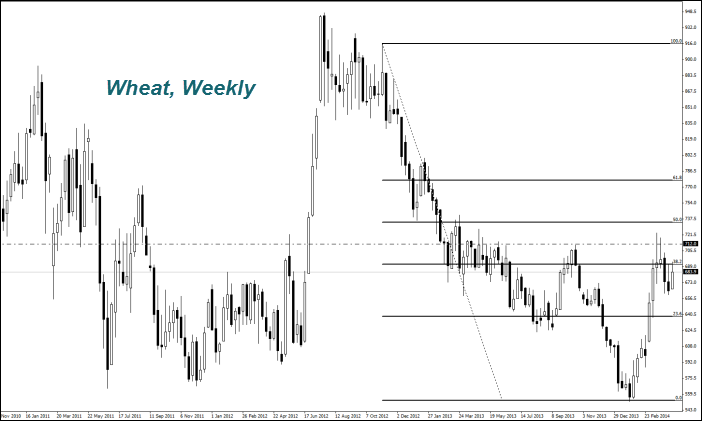

The Wheat prices increased as new Ukrainian authorities are poorly financed farmers in conditions of aggravation of the political situation in Ukraine. Another negative factor was the drought. Agritel lowered the wheat harvest forecast in Ukraine for this year by 1.6 million tons to 18.4 million tons and by 1.8 million tons to 48.1 million tons for Russia (due to the drought). The Corn prices fell slightly. There was 3% of the new crop seeds planted at the end of last week in the United States. This coincides with the USDA prediction in spite of the cold weather. If the weather conditions get improved planting seeds can be up to 10% of the daily total.

News

Paramount Skydance is After CNN

Paramount Skydance is going after Warner Bros. Discovery. They’ve filed a lawsuit in Delaware and are getting ready to...

GM and Ford Are Pulling Back From EVs

General Motors and Ford are quietly stepping back from the aggressive EV plans they were pushing just a few years ago. This...

PayPal Partners with OpenAI and Applies to Become a Bank

PayPal has been under a lot of pressure for a while now: there was a rising doubt if paypal can even still compete with Apple...

The Road to Hell is Paved with Good Intentions: 10% Credit Card Interest Rate Cap

As of January 2026, there is a proposal to cap credit card interest rates at 10% nationwide. The idea is to help Americans...

Iran Currency Collapse and BRICS Stress Test

So, here is what we have; Iranian Rial basically collapsed in early 2026. And it’s happening because the currency is failing,...

How Big Corporations Legally Avoid the 21% Tax

The U.S. corporate tax rate is officially 21%. In theory, that is what profitable companies are supposed to pay. But in practice,...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also