- Analytics

- Technical Analysis

EUR/USD Technical Analysis - EUR/USD Trading: 2016-04-01

Slower expected pace of US monetary tightening boosts euro

The euro has been rising since additional stimulus measures were announced at March 10 European Central Bank meeting. The dovish statement of the Federal Reserve after conclusion of March 16 policy meeting further boosted the shared currency. Will the euro continue strengthening?

The European Central Bank expands its monthly bond purchases, starting from today, to 80 billion euros ($91 billion) from 60 billion euros as ECB President Mario Draghi announced at March 10 policy meeting. The ECB will purchase investment grade bonds issued by non-bank corporations in an attempt to strengthening program’s effectiveness, thus expanding the regular asset purchase program. The expansion of asset purchases will increase the liquidity supply in euro-zone and should put a downward pressure on euro. The ECB also cut the deposit rate from minus 0.3% to minus 0.4% and extended the program until March 2017, noting that it could remain effective even longer to achieve the target inflation rate of just below 2%. The shared currency appreciated after the ECB interest rate announcement as markets were underwhelmed by additional easing measures. At its March 16 meeting the Federal Reserve issued a dovish policy statement as policy makers’ median forecasts indicated two rate hikes in 2016 instead of previously expected four. This further reduced the monetary policy divergence between two major central banks of the world with Federal Reserve slowing the tightening due to increased risks from global slowdown. The US dollar depreciated with respect to major currencies, with slower pace of expected rate hikes making it relatively less attractive and supporting rivals including euro. Today US nonfarm payrolls will be released at 16:30 CET, analysts expect 210 thousand new jobs were created in March. A disappointing jobs report may further weaken the dollar and boost euro. Economic data on Thursday showed the consumer price index in euro-zone fell 0.1% from a year earlier after an 0.2% drop in February. The core inflation, which excludes volatile food and energy prices, edged up to 1% from 0.8%. The continued fall in euro-zone inflation indicates limited effectiveness of ECB measures to stave off deflation. This adds to expectations of additional monetary stimulus measures to aid the economic recovery, which is bearish for euro.

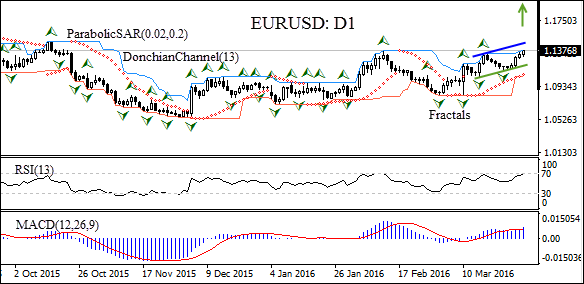

On the daily timeframe EUR/USD has been rising after the ECB President Mario Draghi announced additional monetary stimulus measures on March 10. It was boosted recently after comments by Federal Reserve Chair Janet Yellen indicated Federal Reserve will be cautious with interest rate hikes, keeping rates lower for longer. The Parabolic and MACD indicators have formed a buy signal. The Donchian channel is tilted upward. The RSI oscillator is edging up and has reached the overbought zone. We expect the bullish momentum will continue after the price closes above the upper Donchian channel at 1.1364. A pending order to buy can be placed above that level, and risks can be limited by placing the stop loss below the last fractal low at 1.11431. After placing the pending order, the stop loss is to be moved every day to the next fractal low, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the stop loss level (1.11431) without reaching the order (1.1364), we recommend cancelling the position: the market sustains internal changes which were not considered.

| Position | Buy |

| Buy stop | above 1.1364 |

| Stop loss | below 1.11431 |

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.