- Analytics

- Market Overview

Dow closes at fresh record - 29.12.2017

US stock indices rise despite mixed data

US stock market ended higher on Thursday despite mixed data. The dollar weakness intensified: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, ended 0.4% lower at 92.668. Dow Jones industrial average rose 0.3% to 71th record close 24837.51 this year. The S&P 500 gained 0.2% to 2687.54 led by financial shares up 0.4%. The Nasdaq composite rose 0.2% to 6950.16.

Tax cuts enacted by the tax overhaul are the main driver of stock market rally despite mixed data: the goods trade deficit widened by 2.3% in November to $69.7 billion, which could negatively impact fourth quarter growth. On positive side the Chicago purchasing managers index jumped to 67.6 in December from 63.9, the highest since March 2011. Readings above 50 indicate expansion. And initial jobless claims were unchanged at 245,000 last week.

European stocks pull back

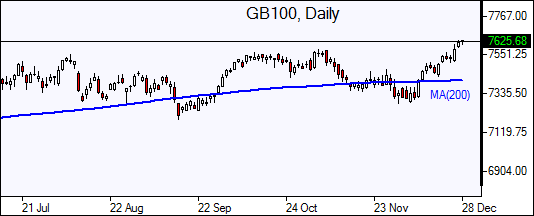

European markets pulled back on Thursday erasing previous session gains in thin trading. The euro and British Pound rally against the dollar continued. The Stoxx Europe 600 index fell 0.3%. Germany’s DAX 30 dropped 0.7% to 12979.94. France’s CAC 40 lost 0.6% while UK’s FTSE 100 inched up 0.03% to all-time closing high 7622.88. Some exchanges, including the UK’s, will close early on Friday. Indices opened mixed today.

Asian markets mixed ahead of New Year

Asian stock indices are mixed in thin trading ahead of New Year holiday. Nikkei slipped 0.1% to 22764.94 on continued yen strength against the dollar. Chinese stocks are rising as central bank said it will let some commercial banks temporarily keep lower required reserves in light of heavy demand for cash ahead of the Lunar New Year: the Shanghai Composite Index is 0.4% higher and Hong Kong’s Hang Seng Index is up 0.2%. Australia’s All Ordinaries Index is 0.4% lower as Australian dollar rally against the greenback persists.

Oil up as US crude stocks drop

Oil futures prices are edging higher today. Prices rose yesterday after the US Energy Information Administration report of bigger than expected drop in domestic crude supplies of 4.6 million barrels last week. Brent for February settlement rose 0.4% to end the session at $66.72 a barrel on Thursday.

See Also