- Analytics

- Market Overview

Financial stocks lead US market higher - 25.10.2017

Dow closes at new record high

US stocks advanced on Tuesday as better than expected corporate reports boosted investor confidence. The dollar strengthening continued: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, edged up 0.01% to 93.929. The S&P 500 added 0.2% to 2569.13 with gains in financial and materials shares offsetting losses in health care stocks. Dow Jones industrial average rose 0.7% closing at record high 23441.76 led by 4.9% and 5.9% jump in Caterpillar and 3M shares respectively on better than expected earnings and profit outlook. The Nasdaq composite index added 0.2% to 6598.43.

Positive earnings reports and anticipated tax cut stimulus are the main drivers of the recent market rally which has elevated stock valuations to historical highs. Treasury yields rose as Trump polled the Republicans on whether they would prefer John Taylor or current Fed Governor Jerome Powell to head the Federal Reserve, and more senators preferred Taylor. Taylor, a proponent of rules in guiding Fed monetary policy, is seen as someone who may put the central bank on a faster path of interest rate increases. Positive economic data also support the view of improving economic performance: both Markit Manufacturing and Services PMIs came in better than expected with composite purchasing managers’ index, a gauge of economic activity, rose to 54.5 in October, a nine-month high.

European stocks slip

European stocks closed lower on Tuesday although country stock indexes ended higher. The euro recovered some of the previous day losses against the dollar while British Pound accelerated its decline. The Stoxx Europe 600 lost 0.4% led by health care stocks. German DAX 30 added 0.1% closing at 13013.19 helped by 6% jump in Commerzbank shares. France’s CAC 40 closed 0.2% higher and UK’s FTSE 100 added less than 0.1% to 7526.54. Indices opened 0.1%-0.2% lower today.

Bank stocks led the gains. Spanish stocks also rose led by Banco Sabadell, Caixabank and Santander shares after Caixa reported the flow of deposits out of the bank had slowed since it moved its headquarters out of Catalonia. In economic news the expansion in euro-zone manufacturing sector accelerated as produce prices rose at the fastest rate since June 2011 while the services sector growth slowed down.

Asian markets rise as China’s party congress ends

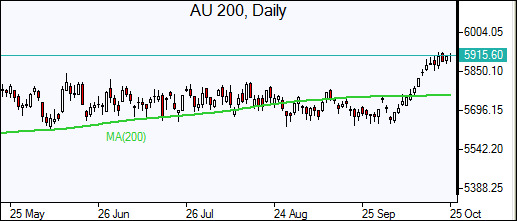

Asian stock indices are mostly higher. Nikkei lost 0.5% to 21707.62 snapping 16-day winning streak as yen inched higher against the dollar. Chinese stocks are higher after President Xi Jinping introduced his Politburo Standing Committee: the Shanghai Composite Index is 0.3% higher and Hong Kong’s Hang Seng Index is up 0.5%. Australia’s All Ordinaries Index gained 0.1% as Australian dollar fell 0.6% against the greenback after report Australian consumer prices declined to 1.8% over year in third quarter from 1.9% in second quarter.

Oil lower ahead of US crude stock report

Oil futures prices are lower today as traders weigh top exporter Saudi Arabia’s Energy Minister Khalid al-Falih’s comment Tuesday their focus remained on reducing oil stocks in industrialized countries to five-year average. Prices rose yesterday despite the American Petroleum Institute industry group report late Tuesday US crude stocks rose by 519 thousand barrels last week. December Brent crude rose 1.7% to $58.33 a barrel on Tuesday. Today at 16:30 CET the Energy Information Administration will release US Crude Oil Inventories.

See Also