- Analytics

- Market Overview

North Korea tensions back in focus - 22.8.2017

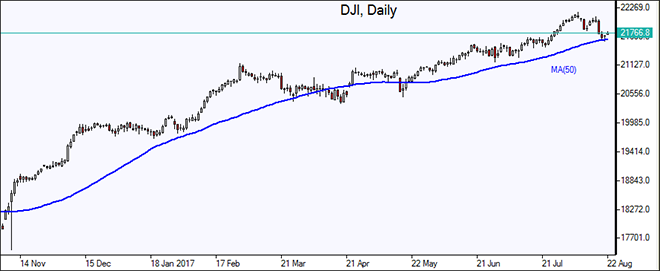

S&P 500, Dow climb while Nasdaq slips

US stocks inched higher on Monday in thin trading amid renewed geopolitical tensions around North Korea as the US and South Korea started annual military exercises after the standoff between US and North Korea following Kim Jong Un’s threats to fire a missile near Guam waters more than a week ago. The dollar weakened: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.3% to 93.08. S&P 500 closed up 0.1% settling at 2428.37, with eight of its 11 main sectors closing higher. The Dow Jones industrial average gained 0.1% to 21703.75, lifted by 1.2% gain in Home Depot shares. The Nasdaq composite index lost less than 0.1% closing at 6213.13 as technology stocks lost momentum.

Treasury yields declined in anticipation of the central banker symposium in Jackson Hole, Wyoming from August 24 to August 26. Investors are concerned about the lackluster inflation even as global economy improves. This makes the likelihood of another Fed rate hike this year lower. Earlier there were expectations European Central Bank President Draghi might use the conference to announce about the start of tapering the monthly 60 billion bond buying program. However later reports suggested Draghi wouldn’t announce a policy shift at the conference. In economic news the Chicago Fed’s National Activity Index, a gauge of US economic activity, fell to negative 0.01 from 0.16 in June.

North Korea tensions weigh on European markets

European stock indices retreated on Monday as tension on Korean peninsula elevated after the US and South Korea commenced annual military exercises. Both the euro and British Pound ended to gains against the dollar. The Stoxx Europe 600 index fell 0.4% following 0.7% loss Friday. The DAX 30 dropped 0.8% to 12065.99. France’s CAC 40 fell 0.5% and UK’s FTSE 100 slipped 0.1% to 7318.88. European stock indices opened 0.5% - 0.7% higher today.

Investors will be watching the Kansas City Fed’s symposium in Jackson Hole, Wyoming, which starts Thursday. Central bankers will speak about inflation and trade relations in light of Trump policies. Fiat shares jumped 6.9% after reports China’s Great Wall Motor Company had expressed interest in buying the Italian-American car maker.

Asian stocks mixed

Asian stock indices are mixed today with investors cautious after the United States and South Korea began annual joint military exercises which North Korea called a "reckless" step toward nuclear conflict. Nikkei slipped 0.1% to 19383.84 despite a weaker yen against the dollar. Chinese stocks are mixed: the Shanghai Composite Index is down 0.1% while Hong Kong’s Hang Seng Index is 1.2% higher. Australia’s All Ordinaries Index is up 0.4% on higher industrial metals prices with Australian dollar little changed against the greenback.

Oil higher

Oil futures prices are inching higher today on signs of tightening US supplies. Analysts expect US crude inventories fell for an eighth straight week. Prices fell on Monday as Organization of the Petroleum Exporting Countries technical meeting with non-cartel members in Vienna didn’t provide any update. October Brent crude lost 2% settling at $51.66 a barrel on London’s ICE Futures exchange on Monday.

See Also