- Analytics

- Market Overview

Will the Growth of Metals Resume? A Technical Look. - 16.1.2013

Chart is based on trading platform NetTradeX

Chart is based on trading platform NetTradeX

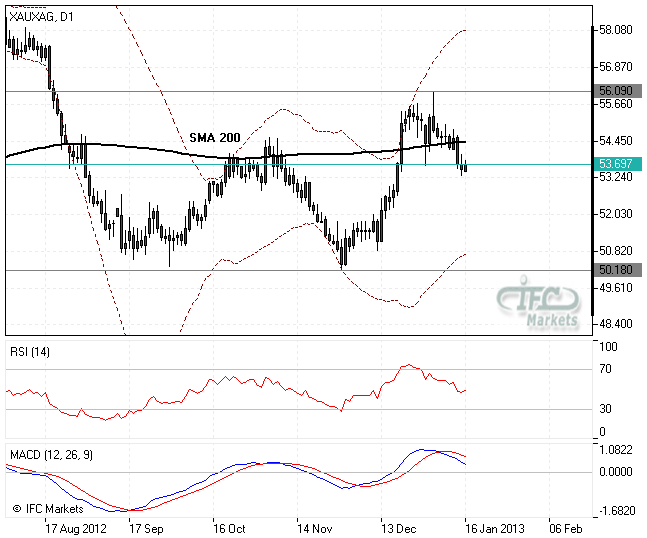

During the observation of XAUXAG graph the formation of unequivocally expressed trend is not observed, as on the graph of gold and silver (Graph 3). The movement was more a lateral one. In November of 2012 XAUXAG has fallen up to a 10-month minimum of 50.18, and at the beginning of 2013 it increased up to the 5-month maximum level- 56.09. Taking into consideration the predomination of side trend, sell signals from RSI and MACD indicators look reliable. But if XAUXAG continues to fall, our prediction about the possible parallel growth of price of gold and silver will get optional confirmation. Historically, high positive correlation is characterized for the two metals. Nevertheless, during the price growth of metals, silver often grows stronger, than gold, which happens probably due to its high volatility. Falling of XAUXAG instrument should be expected, because if the price of silver grows faster, less ounces of the metal are needed in order to buy one ounce of gold, and this is exactly our scenario.

Chart is based on trading platform NetTradeX

Let’s move to a smaller scale- 4-hour graphs can provide more information for making decisions regarding the possibilities of entering the market. Like on the gold graph, on the silver one we may observe the formation of figures of brilliant trend changes. The figure is quite rare, and for this reason its appearance increases the chances of our findings to be accurate. On the silver graph the formation of the figure is over (Graph 4), and the confirming signal must become the overcoming of the resistance area 31.40-31.50 with the aim of 32.60-32.80, just near the upper boundary of descending channel (see Graph 2). The gold graph looks like the latter (Graph 5). The completed brilliant figure says about the possibility of growth with optimistic aim of 1730, even higher of the upper boundary of descending channel. However, let’s wait for the overcoming of the resistance level 1694.

Chart is based on trading platform NetTradeX

Chart is based on trading platform NetTradeX

Finally, let’s pay attention to the 4-hour XAUXAG graph- the same brilliant figure which confirms the changes of trend and falling in quotations with the aim of 52.20-52.30 (Graph 6). However, the analysis of XAUXAG shows that the quotations have fallen below the level of brilliant base, although on the gold and silver graphs rise above the top level of the figure is not observed yet, and these levels stay resistance ones. In this way, if our conclusions about the existence of short-run perspectives of the gold and silver growth are confirmed, XAUXAG instrument will prove to be effective for the analysis of precious metals markets, acting as a leading and confirming indicator.

Chart is based on trading platform NetTradeX

See Also