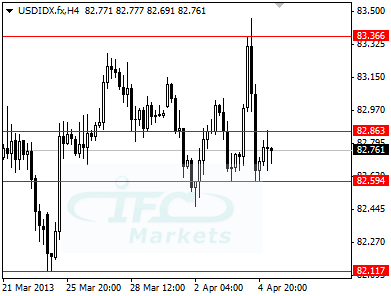

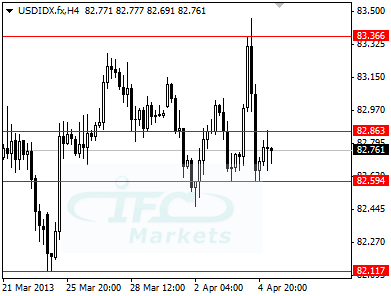

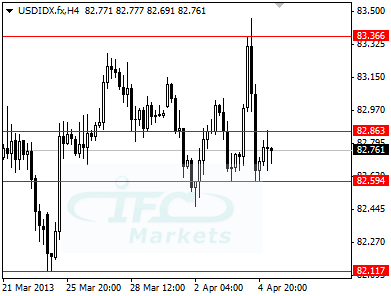

Markets enter in short-term sideways after central banks decisions and ahead of US Non-Farm payrolls, market consensus suggests that in March were added 200K jobs excluding the farming sector, however weaker than anticipated ADP report on Wednesday and sluggish Jobless Claims on Thursday make traders more pessimistic about today’s NFP figure. Yesterday, immediately after US Claims were reported unexpectedly higher at 385K for the previous week compared to 357K two weeks ago, the US dollar index increased sharply to 83.36 probably due to risk-off but afterwards retreated back entering 82.86/82.59 range, as a virtue of employment worsening lowers possibilities of FED asset purchases withdrawal at an earlier stage.

USDJPY kept advancing and inched to a new high for more than 3 ½ years at 97.17 amid traders abandon yen after BOJ monetary stance moved to more aggressive asset purchases on Kuroda’s first meeting. The currency pair retreated earlier today consolidating around 96.21 on profit taking and ahead of important employment news for US, also NIKKEI 225 jumped by 1.58% to 12833.64 on Friday.

At the same time, the single currency against the greenback dropped initially to 1.2750 after ECB decided to hold rates unchanged at 0.75% with Draghi stating that is ready to take further action should it become necessary. However EURUSD followed a strong recovery rising from 1.2750 on short covering and then around 1.2880 probably stop orders triggered sending the pair to 1.2948. Another possible factor driving EURUSD is that traders are becoming somewhat bearish on US dollar due to growing consensus that US NFP will be more sluggish than projected.