- Analytics

- Market Overview

US positive macroeconomic data coming out last week - 11.8.2014

World stock markets showed an upward correction on Friday. Almost the whole past week was rich in positive US macroeconomic data. Investors did not pay much attention to this data, fearing the increased global political risks, due to military conflict in the south-east of Ukraine and mutual economic sanctions against Russia and Western countries. Moreover, the fallout of the US air strike on Iraq was expected. All these events occurred without any special consequences. American Air Force bombed several sites in Iraq. Military action in Ukraine seems to have taken a protracted nature. The Russian stock market has grown heavily after sanctions.

Investors expect the positive influence of import substitution for the Russian economy. Meanwhile, good American economic data was released once again on Friday, which outperformed the preliminary forecasts. Labor productivity index in the second quarter added 2.5%. The wholesale inventories in June increased only +0.3%. Good earning reports for the second quarter of Nvidia Corp and Monster Beverages Corp can be considered as an additional positive factor. Their stocks upped 7.5% and 6.3%, respectively. Bullish correction of the American stock market is still not accompanied by the significant trade volume. It was 16% lower than the 5-day average on Friday, and reached 5.5 billion stocks. There will be no significant American economic data today and tomorrow. Futures on American stock indices are now "in a prominent black".

European stocks are growing the second day as there is no macroeconomic data. We assume that investors have decided to close partially "short" positions, due to the absence of data on significant situation aggravation neither in Ukraine nor in Iraq.

Nikkei has risen today along with the other world stock indices. Moreover, its daily increase was the highest over the four months. Macroeconomic data from Japan has been neutral today. Consumer confidence index dropped, while Machine Tool orders rose. The data on industrial output in June is to be released at 4-30 CET tomorrow morning. The GDP for the second quarter is to be announced in the evening. It is expected to be very negative because of increased sales tax in Japan approved this April. We do not rule out a weaker yen.

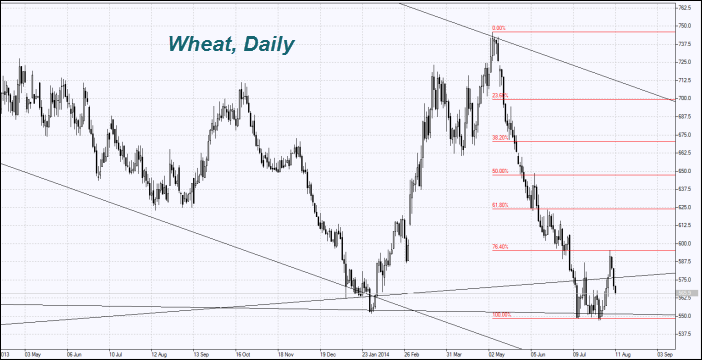

Wheat prices is reducing the third day in a row. Military operations in Ukraine do not interfere with its exports. Note that Ukraine and Russia together provide about one-fifth of the wheat supply to the world market. The USDA monthly review will be released tomorrow at 12:00 CET. An increase in the forecast of wheat production in the United States by the end of this year is expected, from 1.992 billion to 2.01 billion bushels in the July overview. Note that the forecast is underestimated compared with the American crop in 2013, which amounted to 2.13 billion bushels. USDA expects an increase in global wheat production to a three-year high of 190,81 million tons. The review will also include data on corn and soybeans. Ukraine increased the wheat export in July by 60% compared to the last year. There is a severe economic situation in the country, due to the armed conflict.

Copper prices have boosted considerably today after the macroeconomic data release from China. CPI in July added 2.3%. This is below the government goal of 3.5%. Another positive factor can be considered the decline in copper stocks on the London Metal Exchange by 61% compared to the last year, to its lowest level since 2008, 142.3 thousand tons. However, we note that according to the CFTC, the net position for the purchase of copper futures contracts (net-long) fell 12% last week.

Natural gas prices increased due to the earthquake in the state of Oklahoma. Market participants fear that seismic activity might prevent the shale gas extraction.

See Also