- Analytics

- Market Overview

US equities slide ahead of Powell’s speech - 24.8.2018

Nasdaq halts 5-session win streak

US stock market extended losses Thursday in thin trading. The S&P 500 lost 0.2% to 2856.98 with ten out of 11 sectors finishing in negative territory. Dow Jones industrial average fell 0.3% to 25656.98. The Nasdaq composite slid 0.1% to 7878.46. The dollar strengthening resumed: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, jumped 0.5% to 95.586 but is lower currently. Stock index futures indicate mixed openings today.

The major event today is Federal Reserve Chairman Jerome Powell’s speech at a gathering of central bankers in Jackson Hole, Wyoming. Investors are anxious to see what the Fed chief sees as the appropriate monetary policy of the world’s biggest central bank after President Trump criticized Fed’s policy of gradual rate hikes. Kansas City Federal Reserve President Esther George, a voting member of Fed’s interest rate setting committee, said yesterday she thinks “two more rate hikes could be appropriate” this year. She also commented Trump was not first president to complain about higher rates.

DAX 30 opens higher than main European indices

European stocks continued the retreat on Thursday on mixed economic data. Both the EUR/USD and GBP/USD turned lower with both pairs higher currently. The Stoxx Europe 600 index lost 0.2%. Germany’s DAX 30 fell 0.2% to 12365.58. France’s CAC 40 ended flat and UK’s FTSE 100 slipped 0.2% to 7563.22. Markets opened flat to 0.2% higher today.

Pound and euro were pressured by UK government release of the first round of documents detailing the expected impact of a “no-deal” Brexit, when the final deadline of March 2019 for the UK exit could pass without any trade agreement ratified. It was deemed as a signal that London is serious about walking away from talks if it doesn’t get a satisfactory agreement with the European Union. In economic news the declines of preliminary manufacturing purchasing managers indexes for euro-zone and Germany in August showed factory activities expansions in the area and Europe’s largest economy slowed more than expected. However expansion in Germany’s services sector accelerated.

Asian indices mixed as US-China talks end without progress

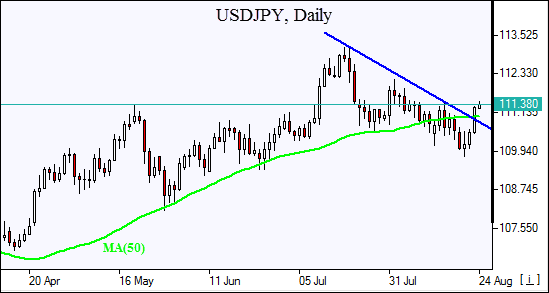

Asian stock indices mixed today with trade tensions still in focus as trade talks between mid-level US and Chinese officials ended on Thursday without any sign of major progress. Nikkei ended 0.9% higher at 22601.77 helped by slowing yen slide against the dollar. Chinese stocks are higher after China’s finance minister said government would increase its spending to support workers and also predicted bond issuance by local governments to support infrastructure investment this year: the Shanghai Composite Index is 0.2% higher while Hong Kong’s Hang Seng Index is down 0.5%. Australia’s All Ordinaries Index rebounded 0.05% while Australian dollar turned higher against the greenback.

Brent rebound continues

Brent futures prices resumed advancing today on expected Iran sanctions which could result in a 900,000 barrel to 1.6 million barrel reduction in Iran exports. Prices ended lower yesterday: Brent for October settlement closed less than 0.1% lower at $74.73 a barrel on Thursday.

See Also